Typically, when uncertainty strikes, money flows from stocks into the safety of the bond market. However, that hasn’t been the case recently. Instead, investors appear to be staying on the sidelines, hesitant to commit in either direction. The volatility in the market is not just visible—it’s palpable.

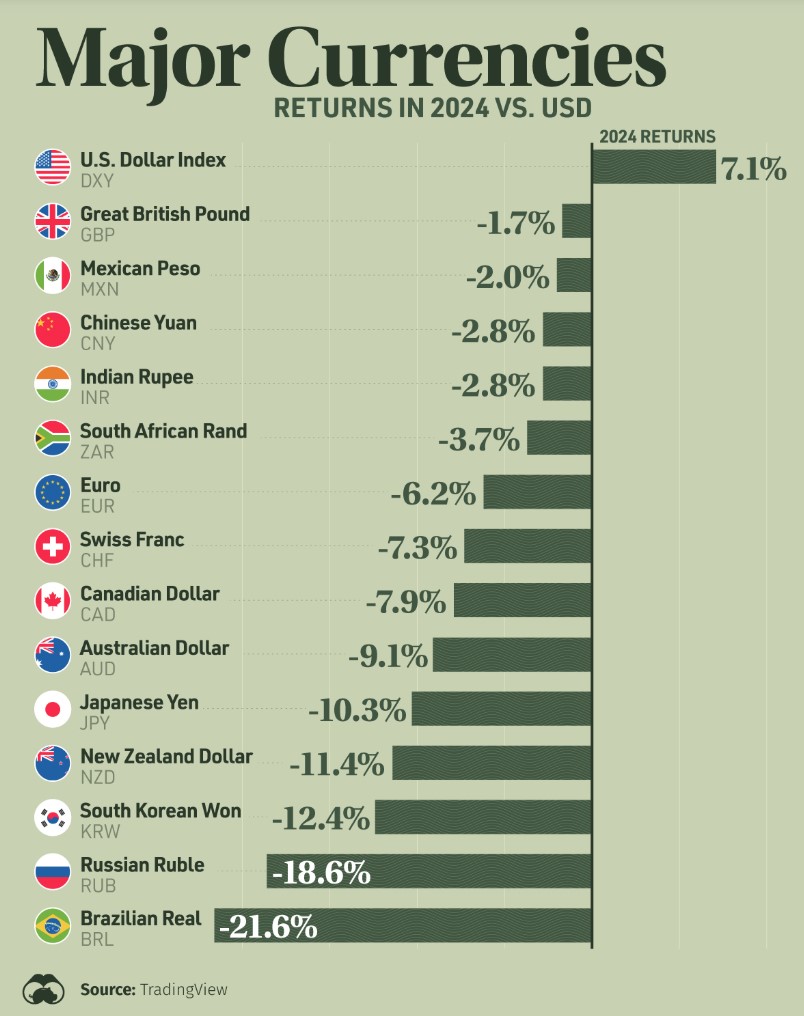

Adding to the complexity is the strength of the U.S. dollar. We’re witnessing a rare and unwelcome trifecta—equity market volatility, bond market instability, and currency pressure—all at once.

There’s also speculation that China, the largest foreign holder of U.S. Treasuries, may be selling off some of its holdings. While this could contribute to rising yields, it’s considered unlikely. The bulk of China’s Treasury purchases were made when interest rates were significantly lower, making any large-scale liquidation costly and impractical.

As for mortgage rates—they remain below the highs we saw earlier this year, but we’ve certainly given up some ground. The Federal Reserve is now facing growing pressure to cut the Fed Funds Rate at its next meeting.

http://www.Your ApplicaitonOnline.com