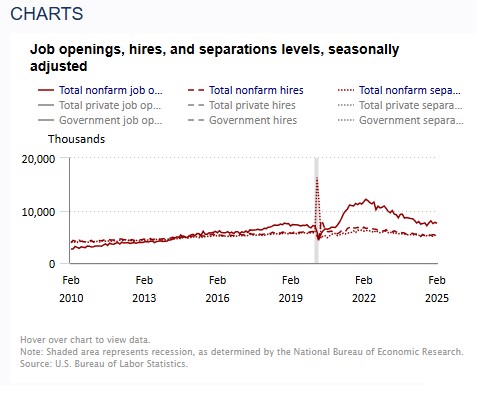

he latest Job Openings and Labor Turnover Survey (JOLTS) data revealed that job openings fell short of expectations. While the downward trend is evident, a bigger concern is that some job postings may be artificially inflated to make businesses appear stronger.

Additionally, the quits rate has dropped to 2%, indicating that fewer people feel confident about finding new job opportunities.

The hiring rate remains at 3.4%, hovering near its lowest level since 2013.

The ISM Manufacturing Index came in lower than expected, with an inflationary impact on new orders, largely driven by tariffs.

As a result, investors are shifting toward safer assets, moving money from the stock market into bonds.

Mortgage bonds are rising as the 10-year Treasury yield declines.

This month, we’re preparing our refinance clients in anticipation of a more significant rate drop by summer. We offer a soft credit pull and can run a “what-if” scenario to explore your refinance options.

http://www.YourApplicationOnline.com