Tariffs are a double-edged sword. On one hand, they can generate revenue to help reduce the U.S. deficit and lower interest rates.

On the other hand, tariffs can significantly weaken consumer demand, increasing the risk of a recession and a deflationary environment.

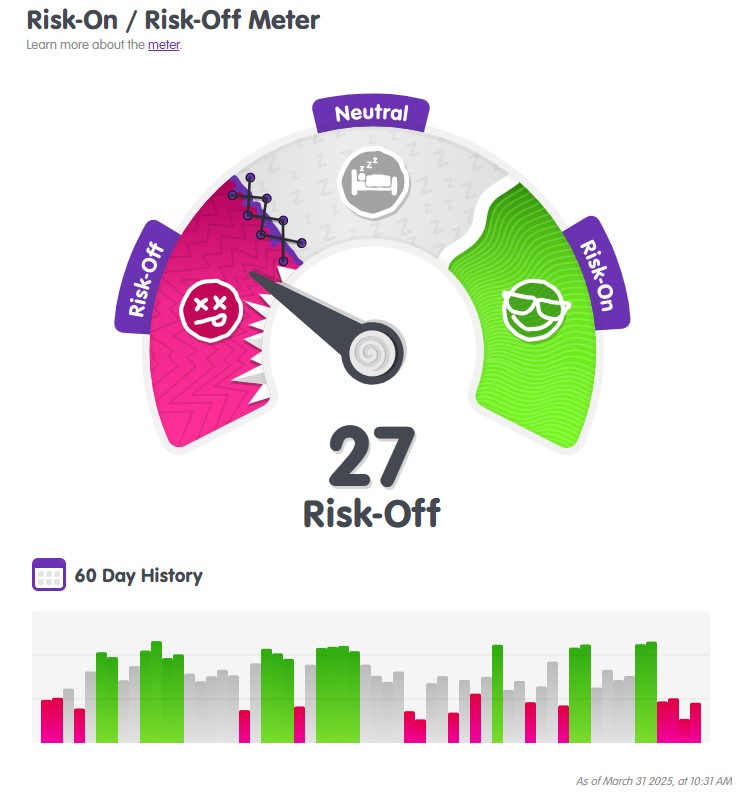

I’ve previously mentioned Risk-Off Trading, but it’s worth revisiting. Capital primarily moves between two markets: stocks and bonds. The markets are reacting strongly to the effects of tariffs, with money shifting between these assets based on risk and reward dynamics.

In the current high-risk environment, investors are pulling money out of riskier assets and seeking safety in bonds.

This week its all about jobs. JOLTS, ADP, Employment Report, and Fridays BLS Jobs Report.

The expectation is unemployment rate rising from 4.1% to 4.2%. The 10-Year bond should react in a rate positive direction.

http://www.YourApplicationOnline.com