The Summary of Economic Projections (SEP) provides insight into where the 19 Federal Reserve members anticipate key economic indicators, including the unemployment rate, GDP growth, core PCE inflation, and the direction of the Fed Funds Rate.

Let’s take a look back at the last SEP report from December 18th:

- Unemployment Rate: 4.3%

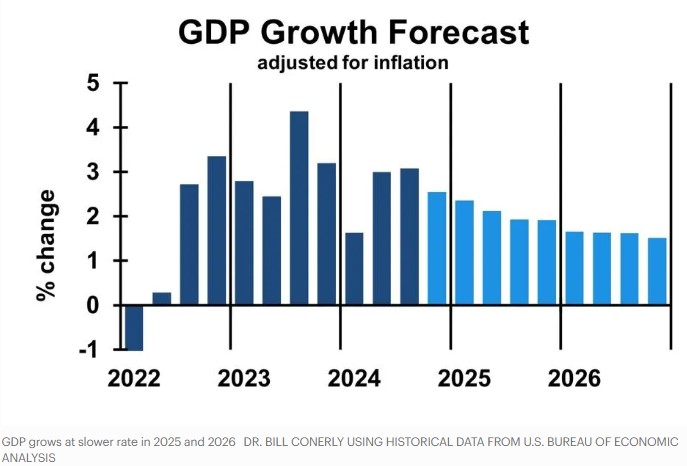

- GDP Growth: 2.1%

- Core PCE Inflation: 2.5%

- Fed Funds Rate Projection: 2 cuts

Current Expectations:

- Unemployment Rate: 4.1%

- GDP Growth: -1.8%

- Core PCE Inflation: Trending lower

- Fed Funds Rate: No clear guidance

Additionally, the Fed may announce an end to its balance sheet runoff, which involves selling bonds. If this happens, there’s a strong possibility they will begin reinvesting approximately $40 billion per month back into Treasuries (Bonds)—a move that could provide positive momentum for mortgage rates.

lets get you qualified http://www.YourApplicationOnline.com