I’m scratching my head. Yesterday, the Consumer Price Index came in cooler than expected, and we saw a strong 10-year auction—yet the bond market barely reacted.

Today, the February Producer Price Index, which measures wholesale inflation, also came in much lower than expected (0.0% vs. 0.3% forecast).

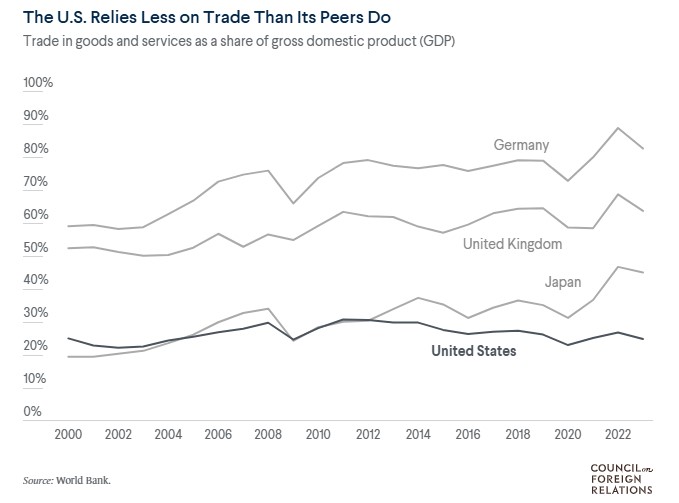

So, what’s going on? The markets are fixated on tariffs and the trade war. This morning, Europe announced tariffs on American whiskey, and in response, Trump threatened a 200% tariff on certain European wines and spirits.

Imagine a group of kids in a sandbox, each claiming their corner as their own. One child takes another’s shovel, so the other retaliates by knocking over their sandcastle. Soon, they’re all piling up sand barriers, blocking each other’s toys, and making it harder for anyone to play.

That’s the trade war—countries imposing tariffs and restrictions, retaliating against one another, and ultimately making it more difficult for everyone to thrive. Just like in the sandbox, the more they fight, the messier it gets, and in the end, no one wins.

The kitten (bonds) keeps defying gravity, but it won’t hold on forever. When yields drop, they’ll drop fast. The flight to safety is real—and it’s happening now.

http://www.YourApplicationOnline.com