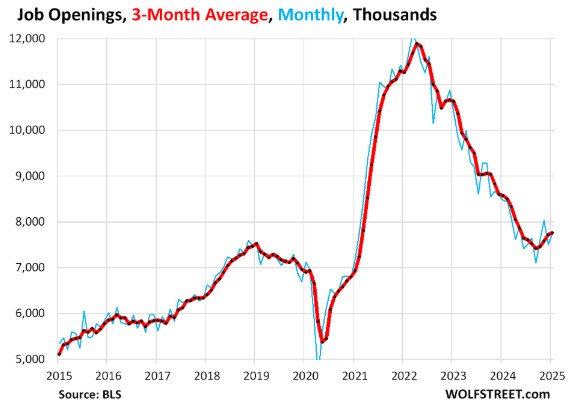

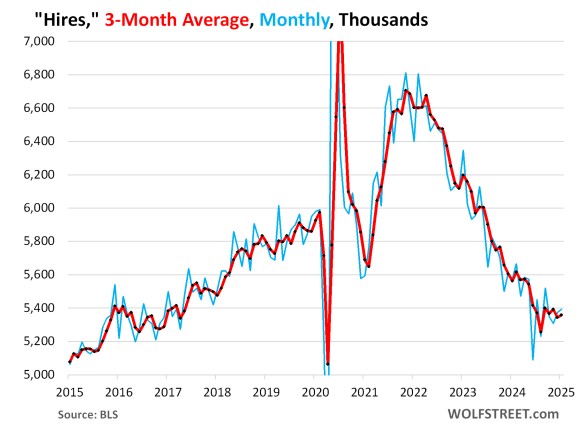

The Job Openings and Labor Turnover Survey (JOLTS) showed a slight increase in job openings, exceeding estimates. However, December’s data was notably weak, and the long-term trend continues to decline.

The BLS Jobs Report saw downward revisions for every month in 2024, totaling a negative adjustment of 263,000 jobs from the original reports.

The Small Business Optimism Index (NFIB) dropped 2 points in February, with the percentage of businesses expecting economic improvement plunging 10 points to 37.

The Atlanta Fed’s Q1 GDP estimate remains negative at -2.4%, with other major forecasters like Morgan Stanley and Goldman Sachs projecting around -1.9% for Q1 GDP.

When thinking about inflation, consider supply and demand. A shift in consumer mindset—such as skipping Starbucks, postponing travel, or choosing chicken over steak—can quickly alter demand and increase supply, impacting overall price levels.

Even if unemployment rises to 5%, that still means 95% of the workforce is employed.

Now is the time to start your home search—get pre-approved and let’s make it happen!

https://YourApplicationOnline.com