After inflation concerns fueled by tariffs and tariff threats, the European Central Bank (ECB) cut interest rates by 25 basis points today.

Was this the right decision, or should they have held steady? Any knee-jerk reaction comes with consequences.

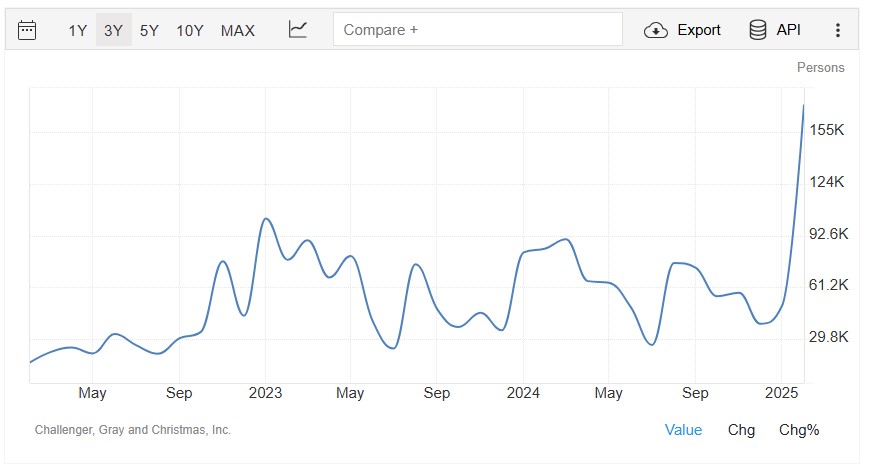

The Challenger Job Cuts Report revealed 172,017 announced job cuts last month—the highest since 2009. Government cuts, particularly in the DOGE sector, contributed to this rise, along with layoffs in retail and technology.

Meanwhile, the leisure and hospitality sector saw job growth, largely due to rebound hiring after weather-related slowdowns in December and January.

Given the historical correlation between the Challenger report and the Bureau of Labor Statistics (BLS) Jobs Report, we anticipate a weaker BLS report tomorrow.

Historically, the Jobs Report has had a direct impact on the bond market—stronger-than-expected numbers push rates higher, while weaker results drive them lower. We expect a softer report and unemployment to hold steady at 4%. This could well translate to lower rates tomorrow.

http://www.YourApplicationOnline.com