Here’s an example: if you have a $500,000 loan at a 6% interest rate, with typical property taxes and homeowner insurance, your total monthly payment would be around $3,210. That breaks down to $642 per $100,000 borrowed.

To simplify further, you can estimate that every $100,000 borrowed will cost you about $700 per month, which gives you a slight cushion to overestimate the final payment.

If you live in a State or County with lower property taxes, you might be closer to $625 per $100,000 borrowed. In higher-tax states like New Jersey or Texas, the figure could be closer to $700 per $100,000 borrowed.

It’s an easy way to get a rough idea of your total monthly house payment.

“I found a beautiful home, Sales price is $700k and I want to put $100k down. $600k loan is 6x$700 or $4,200 a month total house payment.“

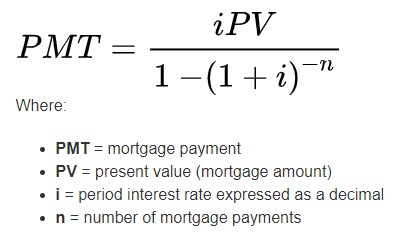

Here is the actual Math if you want to pull out your calculator or just use my simple trick.