The greatest challenge arises when the remedy becomes worse than the problem. Prolonged restrictive Fed rate policies lead to higher costs for everyone, ultimately prolonging inflation.

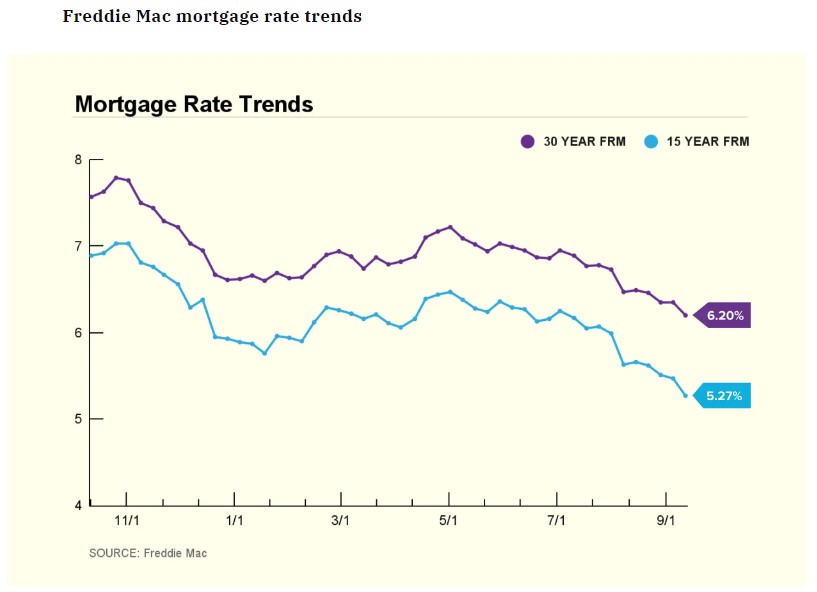

The industry is pricing in a 63% likelihood of the Fed cutting rates by 50 basis points, as reflected in the recent decline in rates over the past two weeks.

Anecdotally, feedback from the real estate community suggests that clients are waiting for a Fed rate cut, regardless of its actual impact on mortgage rates. It’s the perception of rates dropping that is motivating those on the fence to take action.

At 2pm PST the Federal Reserve will release a statement on the rate cut and a summary of economic projections.

Reach out to our team to navigate your refinance/purchase. www.YourApplicationOnline.com