What will the Federal Reserve actually do on the 18th? The market is expecting, and has priced in, a 0.25% rate cut. Personally, I believe the cut should be more aggressive—at least 0.50%.

The Fed has effectively shifted the goalposts regarding the timing and size of future cuts. The current unemployment rate is 4.2%, slightly down from 4.3% last month.

Interestingly, 16 out of 19 Fed members predicted unemployment wouldn’t exceed 4.1% this year—yet here we are.

The market is anticipating a 1% rate cut this year and an additional 1.25% next year. Let’s hope the Fed moves forward and breaks free from their analysis paralysis.

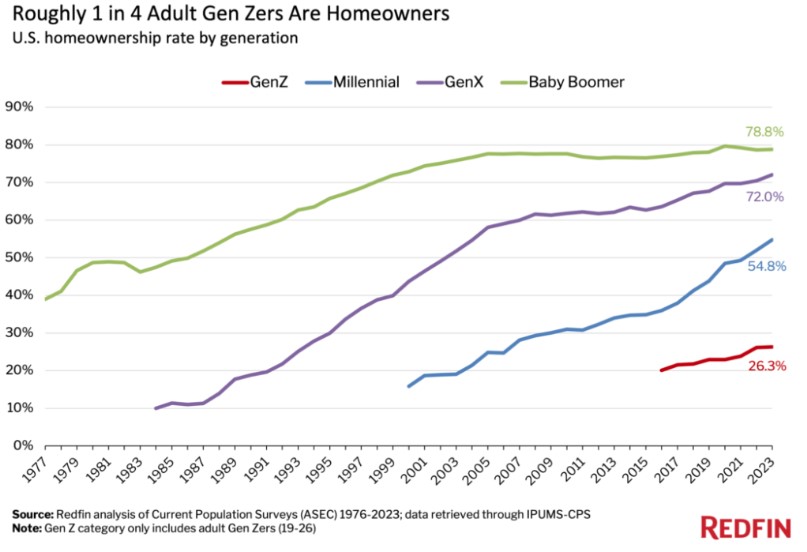

Let’s take a look at the housing market through the lens of different generations.

At age 30, the homeownership rate was 48% for Boomers, 42% for Gen X, and 33% for Millennials. People are waiting longer to get married, have kids, and buy homes. However, by age 40, those rates rise significantly, and Millennials begin to catch up with Gen X and Boomers in homeownership.