The question I get asked every day is: when and by how much will rates drop?

There’s a compelling case that rates will not only fall, but do so sooner than expected.

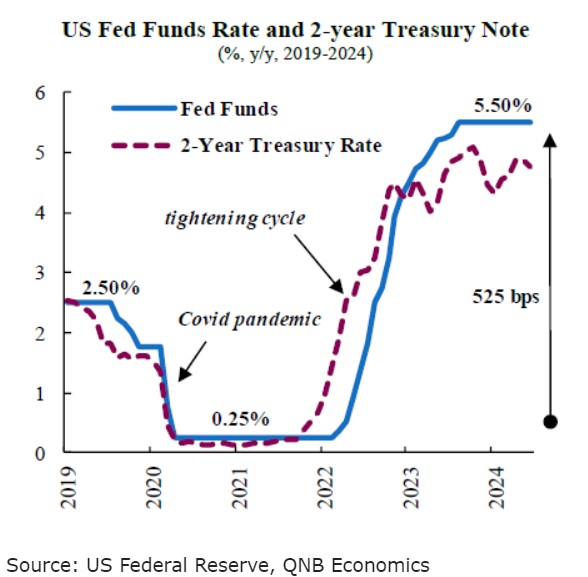

If we look at the differential between the 2-year Treasury and the Fed Funds rate, the Treasury is about 1.6% lower. This is a Large gap. Large enough that we have to go back to the 2007 gap.

The Fed aggressively cut interest rates, but ultimately lagged behind the curve, leading to the onset of the 2008 recession.

The Fed is significantly behind the curve and once again needs to take aggressive action to prevent a recession.

The Federal Reserve Meets September 18th.