With a short week in front of us, its all about Jobs report. JOTLS which measures Job Openings for July is expected to fall slightly to 8.1M.

The hiring rate fell to 3.4% which is the lowest since 2013. This does not include Covid which was 3.1%. Another indication of a slowing jobs market.

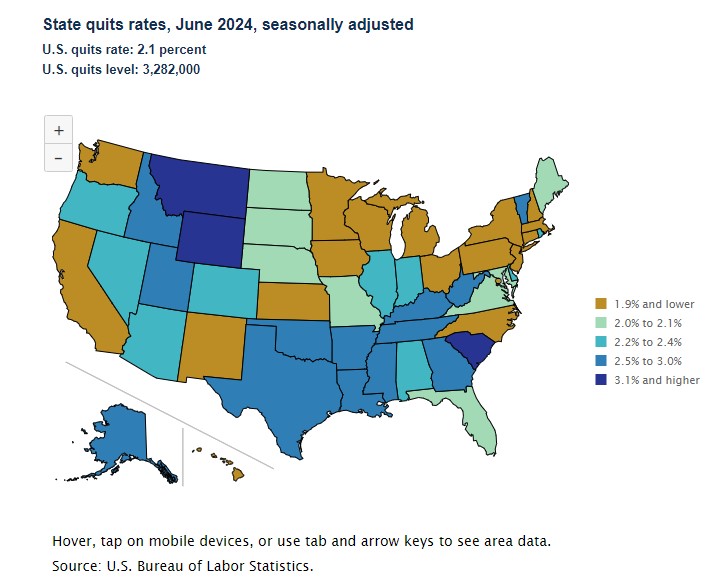

There is other data point within the JOLTS report, the Quit rate. The June report showed the Quit rate fall to 2.1%.

Rates continue to improve and with the jobs report ahead of the Fed meeting September 18th, we are set for a minimum 25bp cut and potentially a 50bp cut.

Historically, September has often been a challenging month for the stock market. The market consists of both stocks and bonds. When investors sell stocks, the proceeds typically don’t remain idle; instead, they are often reinvested in short-term bonds. This shift can be beneficial for mortgage rates.