Yesterday, we saw the Bureau of Labor Statistics (BLS) revise its jobs report, revealing that the number of jobs from March 2023 to March 2024 was overstated by over 818,000.

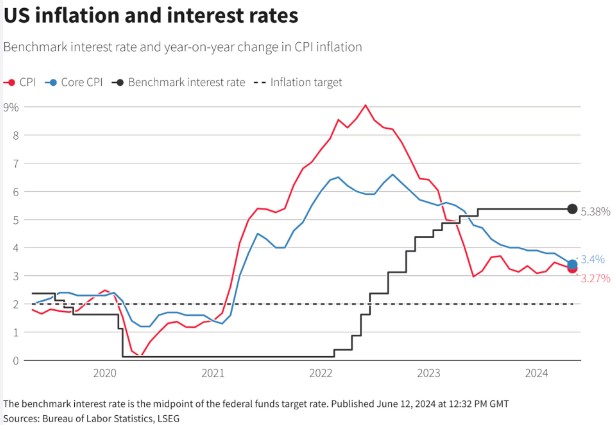

On the same day, the Federal Reserve released the minutes from its July 31st meeting, where they acknowledged the errors in the BLS report. Despite the continued goal of achieving 2.0% inflation, the inaccuracies in the jobs data have increased the pressure to lower interest rates sooner rather than later.

The Fed also noted that consumers are increasingly making only minimum debt payments, a sign of growing financial stress. The key takeaway from the minutes is that the Fed is laying the groundwork for a potential rate cut on September 18.

Additionally, Philadelphia Fed President Patrick Harker, who is not a voting member this year, made a noteworthy statement.

“as the rates come down we will see the Lock-In Effect subside and there will be more supply. “

He was mainly referring to builder costs and financing coming down but it also applies to those homeowners with low interest rates.

Get yourself, clients and friends ready for rates to drop and the housing market to really heat up.