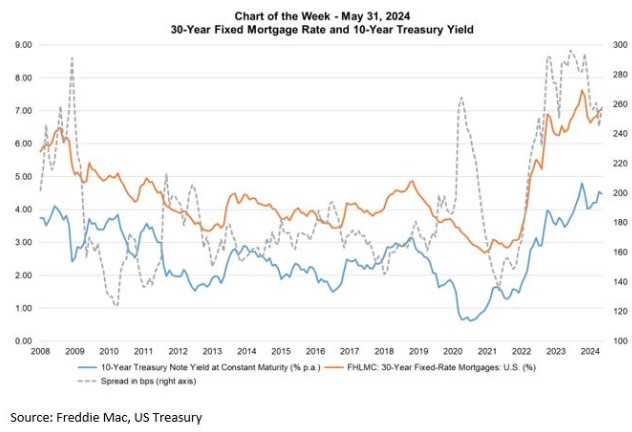

There is a spread between mortgage rates and the 10-year yields that is worth exploring. Currently, the spread is 260 basis points (bps), which is wide from a historical perspective.

This indicates that those holding these mortgages will likely refinance sooner rather than later. This is caused by the servicing premium associated with these loans. Lenders bake in that cost to protect against an early refinance.

As rates start to drop, so does the yield spread.

Currently, the 10-year yield is under 4% and likely to drop below 3.80%. When the 10-year yield falls to 3.80%, the spread narrows to 230 basis points. At that point, the 30-year fixed mortgage rates could fall to 6.125%. If the 10-year yield drops below 3.65%, those mortgage rates could hit 6% or lower.

The Federal Reserve met yesterday and sounded more dovish than before but still maintained the 2% inflation target. The Fed left rates unchanged unanimously. Powell’s comments below:

- We gained confidence on inflation, just want to see more good data

- We can afford to start dialing back restriction with current PCE at 2.5% and core at 2.6%

- The time is approaching, if we get the data we think, September cut is on the table.

Initial Jobless claims rose 14,000 to 249,000. This is the highest level in a year.