As economic data continues to suggest a soft landing and no recession, we have effectively trimmed the branches and limbs.

Now it’s time to tackle the core issue of interest rates. Our problem lies with the high Federal Reserve rate.

Prolonged high borrowing rates for businesses result in increased costs for borrowing and expansion. Ultimately, it’s the consumer who bears these costs.

At this point, the cure is worse than the disease.

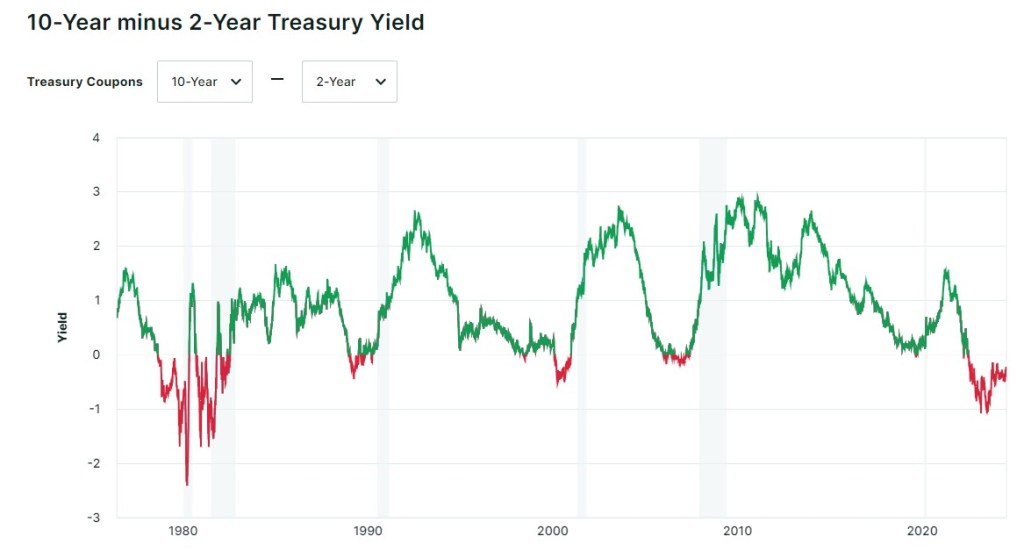

The graph below demonstrates the differential between the 10-year and 2-year yields. Currently, the 2-year yield is higher than the 10-year yield, an unusual situation that is evident in every recession.

However, in our case, we are moving in the right direction, as indicated by the green trend. This is another sign of potentially lower interest rates in the near future.