Looking at loans originated between 2022 and 2024:

- 2M with rates between 6% and 6.5%

- 2M with rates between 6.625% and 7%

- 2M with rates above 7%

We are advising clients to hold until there is a 1-point drop in their current rate. However, even a 0.5% rate drop might take only 12 months to recover the associated costs.

As we get closer to borrowers’ past low rates, the potential for either refinancing or selling and buying increases significantly. The pool of borrowers is much larger:

- 5.5%: 9.5 million borrowers with rates of 4.5% or higher

- 6.125%: 7.5 million borrowers with rates of 5.125% or higher

- 6.625%: 5.5 million borrowers with rates of 5.625% or higher

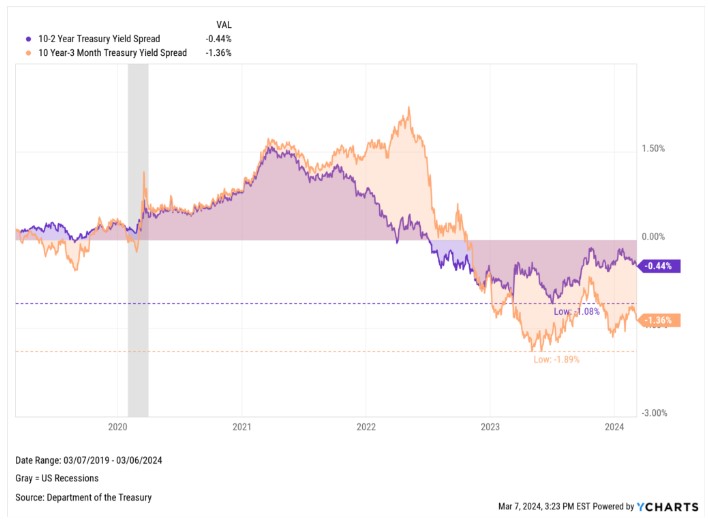

Once the Fed starts cutting rates, short-term rates will fall, and the inverted yield curve (where the 2-year yield is higher than the 10-year yield) will revert. This means ARM loans will become more favorable.

Bottom line: a wave of opportunity is coming. Get ready by getting pre-approved, dusting off those W-2s and pay stubs, and preparing to act.