The University of Michigan has released its Consumer Sentiment Index, showing a decline in consumer confidence from 68.2% to 66%. This marks the fourth consecutive drop.

Inflation expectations have decreased slightly from 3% to 2.9%, and the employment outlook remains weak. Additionally, spending intentions across various categories have also declined.

This trend indicates that consumers are becoming more discerning about their spending habits. The Consumer Price Index (CPI) has been adjusted from 2.5% to 1.4%, and import prices have been revised from 3.8% to 1%.

These are promising indicators that the Federal Reserve (FED) is monitoring closely ahead of potential rate cuts.

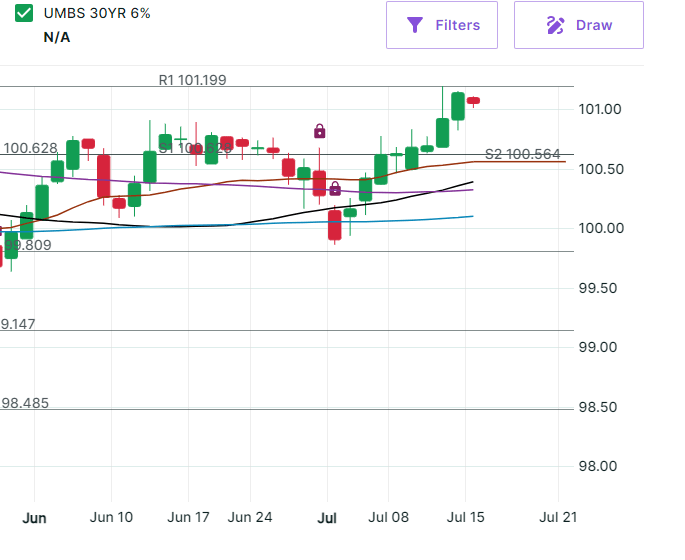

Though rates are far from their lows a few years ago, they are very much inline historically. Green is lower rate movement.