The Feds given yesterdays Soft Consumer Price Index inflation report, are starting to see the light and in favor of cutting rates sooner than later.

Today we see more rate improvement even from yesterdays big move.

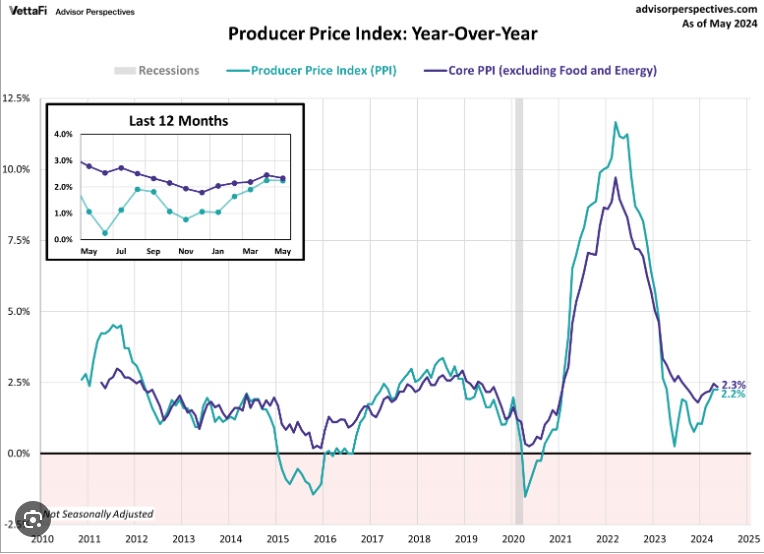

The Producer Price Index (PPI), which measures wholesale or producer inflation, rose by 0.4% in June, surpassing the expected 0.1%. Year-over-year, producer inflation increased from 2.4% to 2.6%.

The reasons behind this increase are not entirely clear and have raised some concerns. One theory is that as producers slow production, their suppliers are earning less and may be raising their prices, passing the additional costs on to the producers.

Bottom line is we are moving in the right direction regardless of the bumps in the road.

Have a fantastic weekend.