There is a dichotomy between Hawks and Doves, especially a shift towards a more Dovish approach concerning potential rate cuts as early as September.

Yesterday, Powell addressed the Senate and is set to testify before the House today. He acknowledged the slowing economy, rising unemployment, and downward revisions in GDP estimates.

Another significant indicator is the increase in Corporate Bankruptcies. June saw 75 new filings, surpassing pre-pandemic levels. This year has recorded 346 filings so far, marking a 13-year high. It’s worth noting that the BLS Jobs Report heavily incorporates the Birth/Death model, which tracks business startups and closures. However, recent Jobs Reports have consistently exceeded actual employment figures.

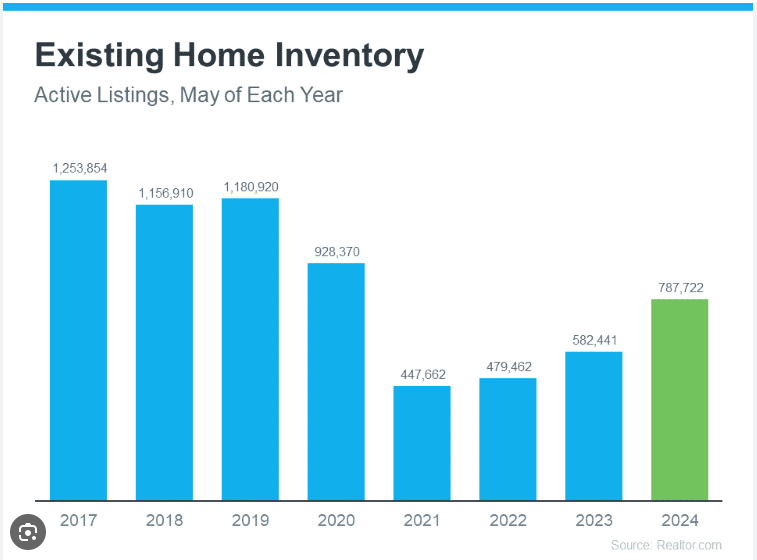

Shifting gears, lets talk Housing Inventory and why its important to look under the covers to see what is really going on.

Inventory has risen 6.7% in June and is up 37% from last year. Wow you say, well if the inventory is low to begin with, a small change can amplify reality. Also two-thirds of this rise is from two states, Florida and Texas.

Comparatively, the Midwest is 49% below pre-pandemic levels, while the Northeast is 57% below.