The Federal Reserve is shifting focus from inflation to the job market. Sustained high interest rates contribute their own inflationary pressures due to increased business costs.

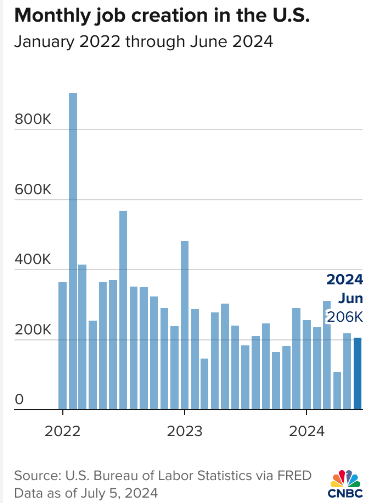

According to the Bureau of Labor Statistics (BLS), 206,000 jobs were added, meeting expectations. However, given the BLS’s tendency for revisions, April and May saw 111,000 fewer jobs combined. It is anticipated that June’s figures will also be revised downwards.

Here are my thoughts: The Federal Reserve is beginning to indicate a move towards rate cuts, which is positive news. I’ve spoken with several clients who are becoming anxious about rising competition as rates decrease and more buyers enter the market. This trend is promising because it should also benefit sellers.

Have a fantastic weekend! Feel free to reach out via call, email, or text anytime—I’m here to assist.