The recent JOLTS report revealed a decline in job openings, particularly noticeable in the Leisure and Hospitality sector with a decrease of 109,000 openings—a sector that had previously shown robust job growth.

Despite this, the Labor Turnover or Quit rate has remained steady at 2.2% for the sixth consecutive month, reflecting an overall softness in the labor market.

Looking ahead, if the upcoming ADP and BLS Jobs Report indicates lower numbers as anticipated, and the unemployment rate surpasses 4%, there could be further improvements in rates.

On a different note, both the CoreLogic Home Price Insights and Black Knight HPI have reported heightened home values, with April showing a 1.1% increase following a 1.2% rise in March. Black Knight specifically noted a 5.1% year-over-year increase.

Over the years, I have observed a convergence of various factors in the industry. Consumers today are more cautious and discerning about their spending habits, choosing when and where to allocate their funds wisely.

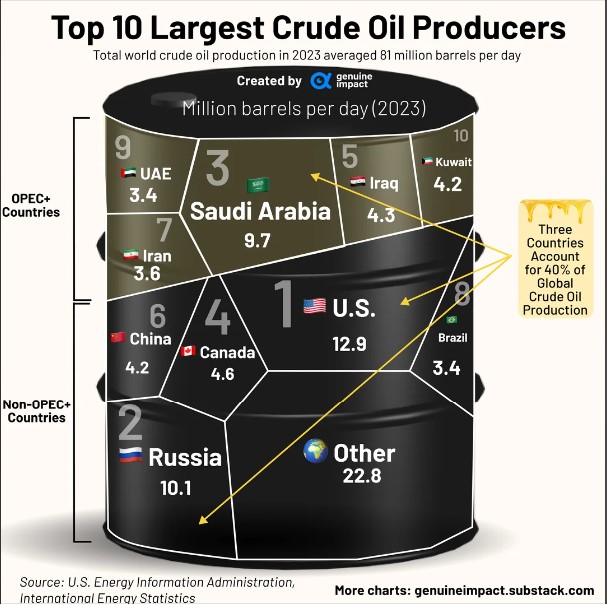

With eight OPEC+ producers planning to ramp up production in the coming months this should lead to reduced oil prices and easing the energy component of inflation.

It seems that the Federal Reserve’s sought-after data and trends are aligning, providing a clearer picture of the economic landscape.