Case Shiller Home Price Index, year over year 6.5%.

FHFA House Price Index year over year 6.7%.

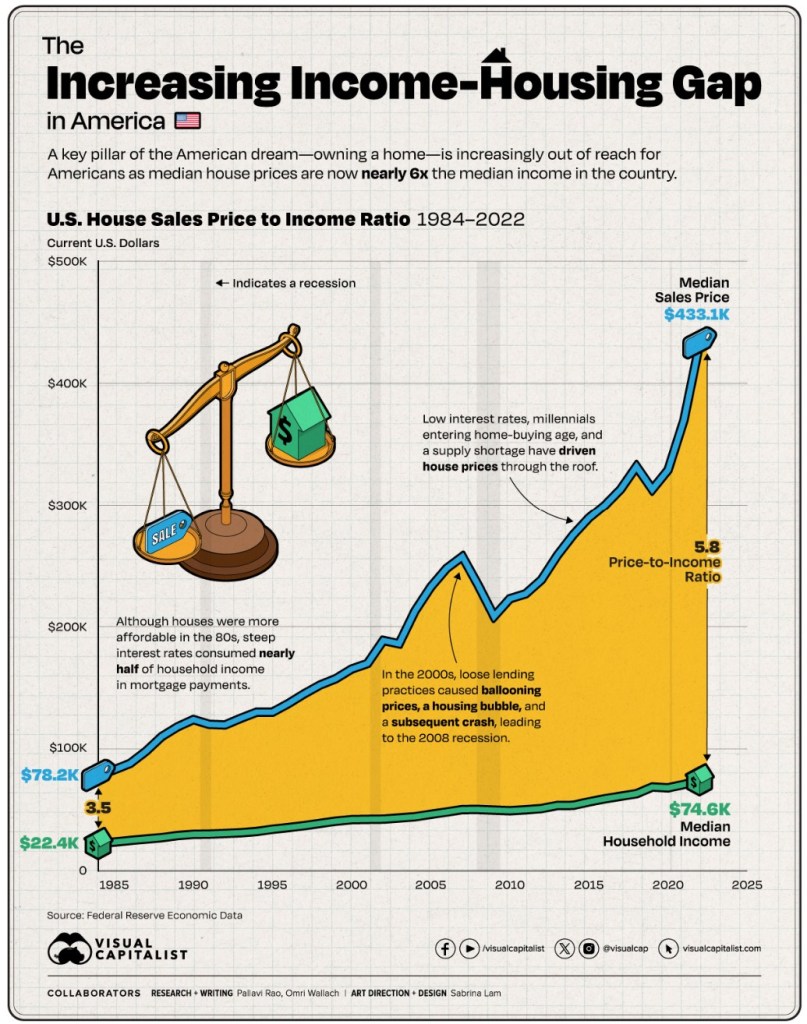

The problem is that the affordability gap continues to widen, driven by the persistent housing shortage. Incomes can’t keep up, so something has to give.

It’s a conundrum. Lower interest rates enable sellers to sell and buyers to buy. This frenzy can lead to skyrocketing prices as more buyers emerge. We saw this happen in 2020 when rates dropped.

I believe that lower rates will encourage sellers to finally put their homes on the market. Many of my clients are ready to sell. Some bought during the pandemic and have since realized their new location no longer suits them. Others are looking to downsize or upsize.

Even though close to 30% of the home purchases are first time home buyers, quite a number of them are getting help from their parents to make up the Price to Income gap.