Mortgage applications have shown resilience despite higher interest rates, with a 5% increase from the previous week. However, they are slightly down compared to the same period last year.

Refinancing activity has surged, up 11% even with rates being 0.75% higher than last year. This suggests that despite the higher costs, homeowners are still seeking to refinance their mortgages, likely due to various factors such as reducing monthly payments or accessing equity.

Federal Reserve Chair Jerome Powell’s recent remarks on U.S.-Canadian economic relations indicated a concern about the stagnation in reaching the Fed’s 2% target and a decrease in confidence. This sentiment could impact the outlook for future rate cuts, potentially leading to a more cautious approach by the Fed.

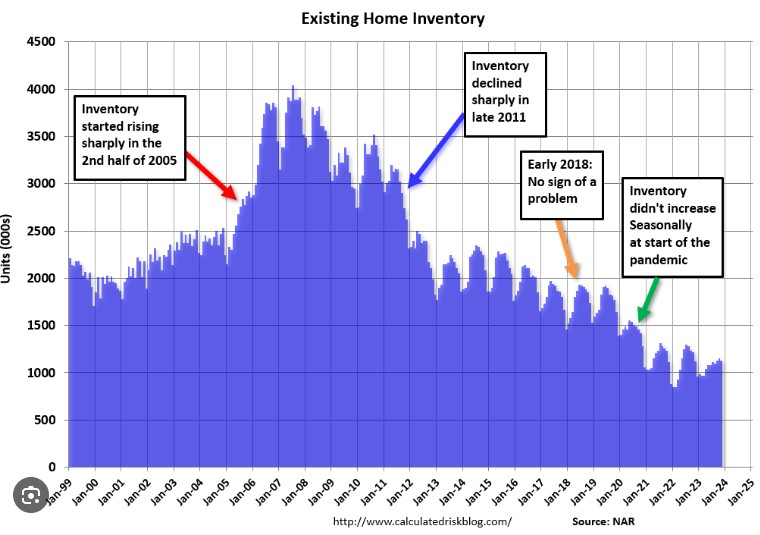

The sentiment expressed about the current state of the housing market reflects a broader trend observed in the industry. Low inventory levels coupled with higher interest rates are causing many agents and borrowers to adopt a cautious stance, resulting in a sort of holding pattern. While there is an expectation that these challenges will eventually subside, the process may be slower than desired, creating uncertainty in the market.