The Personal Consumption Index (PPI), which measures wholesale and producer inflation, rose by 0.2%, falling below expectations. However, food prices saw a notable increase of 0.8% month-over-month, which is lower than February’s 1.1% hike.

The Core rate, which excludes food and energy prices, rose within expectations.

It’s important to avoid knee-jerk reactions in response to these fluctuations. Instead of watching dogs wagging their tails to predict where things are going, it’s wiser to follow the footprints.

In the background over the last two plus years, the Fed has been engaged in Quantitative Tightening, meaning they’ve been gradually selling off their balance sheets, including Treasuries and Mortgage-Backed Securities, for years now.

Now, they’re considering Quantitative Easing, which is essentially the reverse. This is a strategy previously employed post-2008 financial crisis and more recently during the 2020 pandemic.

When the Fed purchases Securities and Mortgage-Backed Securities, it typically leads to a drop in rates.

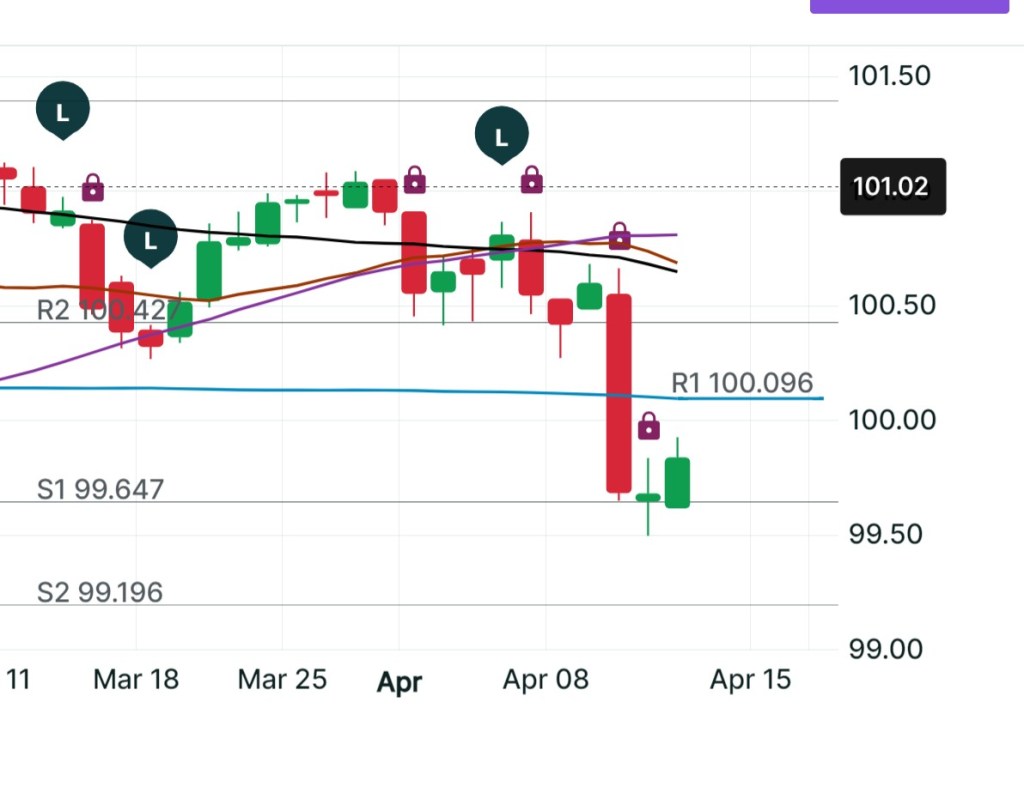

Wednesday as evident in the graph below, was tough on rates. Down is lower rates. This represents about a 3/8 increase in rates. Since then we are starting to recover.