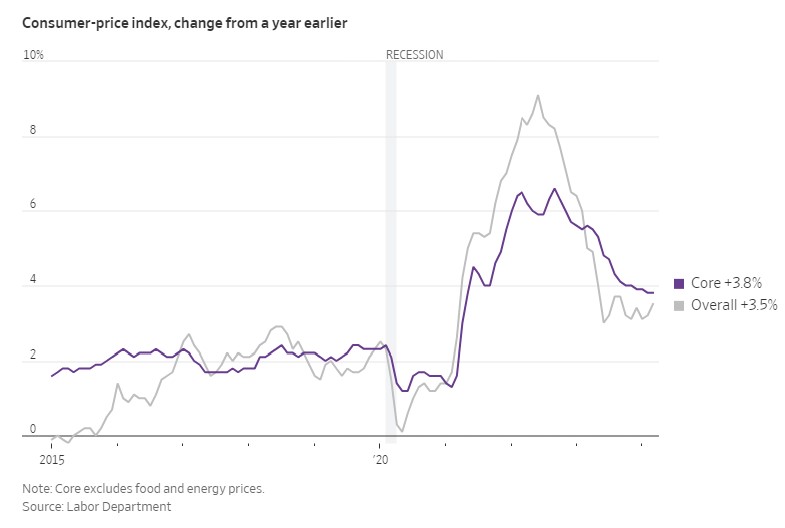

The Consumer Price Index (CPI) rose by 0.4% in March and 3.5% year over year, slightly exceeding our expectations of 0.3% and 3.4%, respectively.

The larger concern arises from the fact that both January and February also experienced higher-than-anticipated increases.

The bottom line is that the Federal Reserve (FEDs) is not pleased. Additionally, the differential between the 2-year and 10-year bond inverted yield curve is troubling. An inverted yield curve means that shorter-term yields are higher, which, upon reflection, doesn’t seem logical.

In theory, holding money for a longer period should yield higher returns.

Let’s all take a deep breath and review the graph below. Inflation is down significantly. It’s just not where we or the Federal Reserve wants it.