Today’s market reaction is influenced by Friday’s data, particularly the release of the Personal Consumption Expenditures (PCE). PCE rose by 2.8% year over year, with a 0.3% increase from January.

While these numbers were within expectations, they raise the likelihood that the Federal Reserve will hold off on cutting rates in the near term.

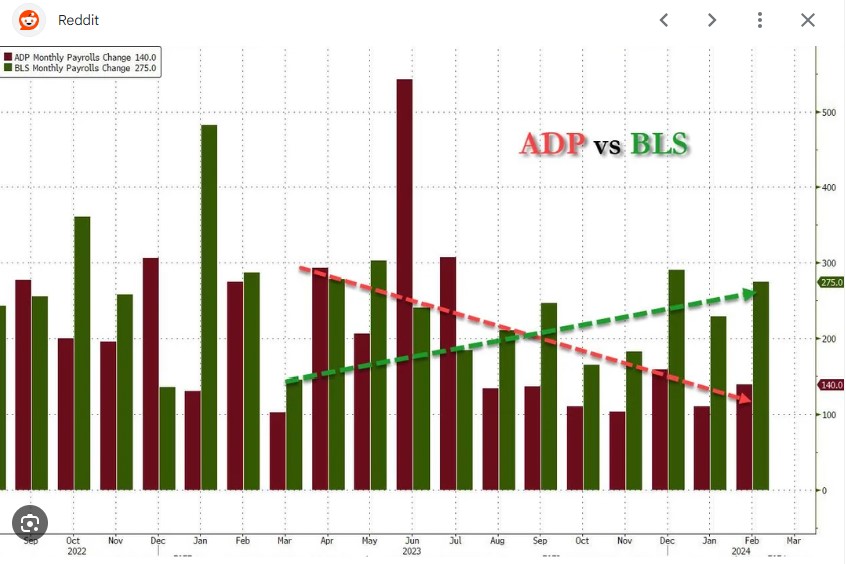

Looking ahead to Jobs Week, the ADP and BLS Jobs Reports are set to be released on Wednesday and Thursday, respectively. The market anticipates the creation of 130,000 jobs for ADP and 200,000 for the BLS report, with the unemployment rate expected to remain at 3.9%.

It’s almost as if I could pull up a post from two months ago and be saying the same thing. It feels like we’re waiting around for just the right song to gather our nerve and ask that girl to dance.

Problem is, the song isn’t changing, and we need to get moving.