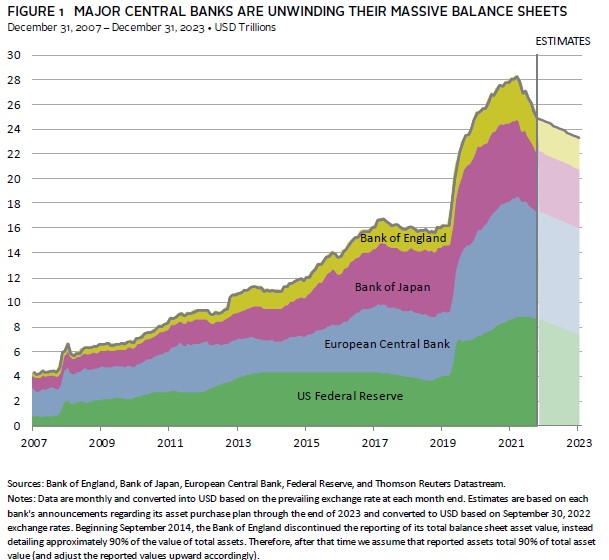

We’ve previously discussed Quantitative Easing (QE) and Quantitative Tightening (QT), but let’s recap. QE and QT are monetary policies that either increase or decrease the central bank’s balance sheet. QE expands the balance sheet, whereas QT contracts it to curb inflation by raising interest rates.

The Federal Reserve has indicated the necessity to slow QT and shift towards a QE stance, thereby expanding their balance sheet and subsequently cutting rates.

Another persistent inflationary factor in the CPI is shelter costs. It’s important to note that while CPI examines around 80,000 data points for rents, Truflation measures over 10 million data points. Truflation indicates a 2.07% increase in rents, as opposed to the CPI’s reported 5.7%. We’re aware that there’s a lag in this data, and this should be reflected in upcoming CPI reports.

Overall, I foresee a trend towards lower Federal Reserve rates, inflation nearing 2.0%, QE on the horizon, and with the NAR Settlement, potentially increased inventory.

Exciting developments ahead.