Consumer Price Index (CPI) as we heard yesterday, was slightly higher but overall flat. Tomorrow, the Producer Price Index (PPI) will be released. PPI measures their cost for goods and services.

The expectation is a rise of 0.3% and a year over year reading from 0.9% to 1.1%. Core reading is expected to rise 0.2% with the year over year expected to fall from 2% to 1.9%.

Personal Consumption Expenditures -PCE is out at the end of the month.

What this means: It’s a little good mixed with a little bad. It’s not the nudge we need for the FEDs to step up their rate drop.

Rates are hanging on by their finger nails. Great improvement the last few weeks.

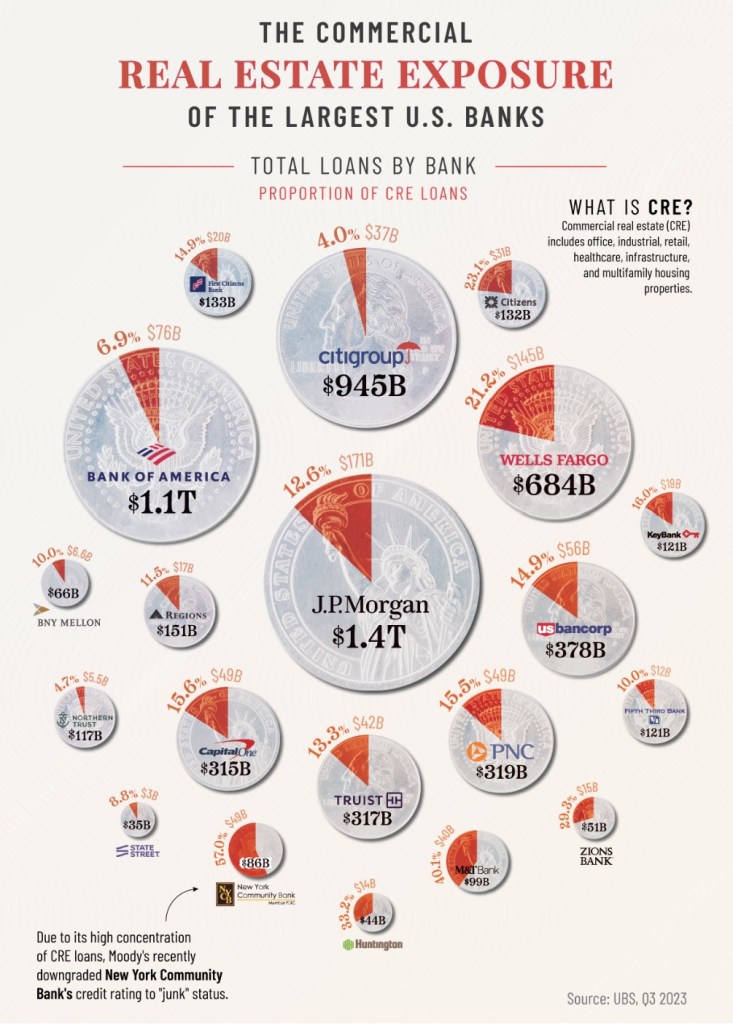

With Commercial Banks in the News, I thought I would share this interesting graph of bank exposure.