The Producer-Price Index – PPI rose 0.3%, and the Core PPI rose 0.5%, both far hotter than expected.

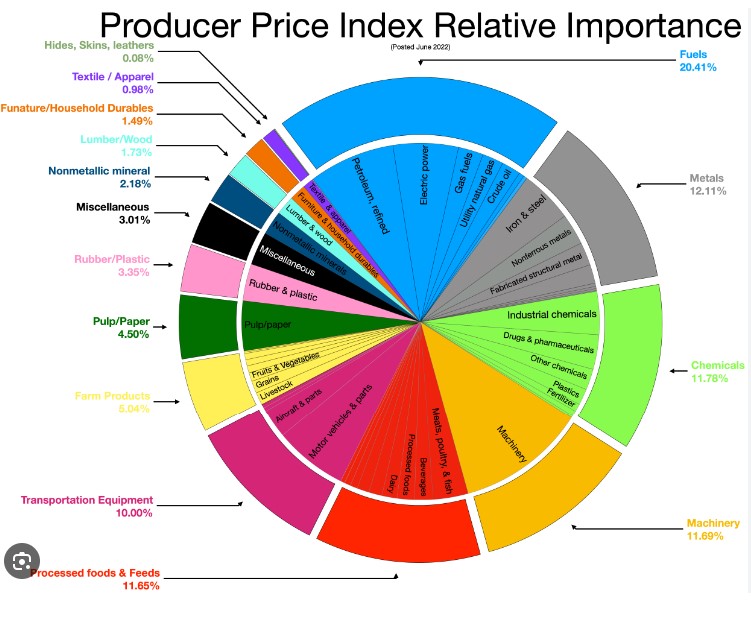

PPI measures the average change in selling prices received by domestic producers over time. It is a measurement of inflation at the wholesale level.

Let the significance of this sink in. This measures the change in prices before they reach the consumer.

The Feds look at this number more seriously because it has significantly more data points than the CPI and focuses on the cost of production, not the cost of consumption.

This does not bode well for Fed Rate Cuts in March or even June. This report reminds us we are not out of the woods despite how hard we stomp our feet.