Let’s Talk CPI and PCE. it’s important so put down your cell phones and pay attention.

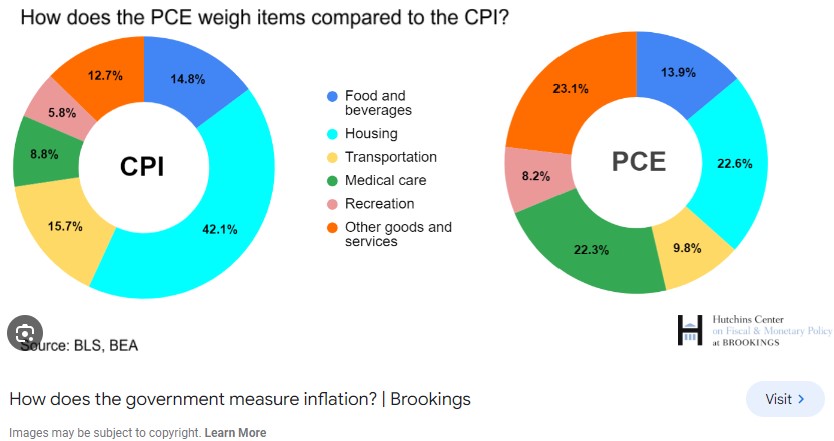

CPI updates the “weight” of its items Annually, while PCE updates Quarterly. So what does that mean?

CPI typically has a higher inflation rate because they can not capture in relative real time consumers switching to cheaper products.

To get a bit further in the weeds, CPI only captures a narrow definition of Urban consumer expenditures made directly from Consumers. PCE considers expenditures made by all consumers as well as those made by other third parties.

Here is an example: A Healthcare insurance provider who purchases prescription drugs on behalf of patients. PCE weighs health care at 22.3% while CPI is at 8.8%.

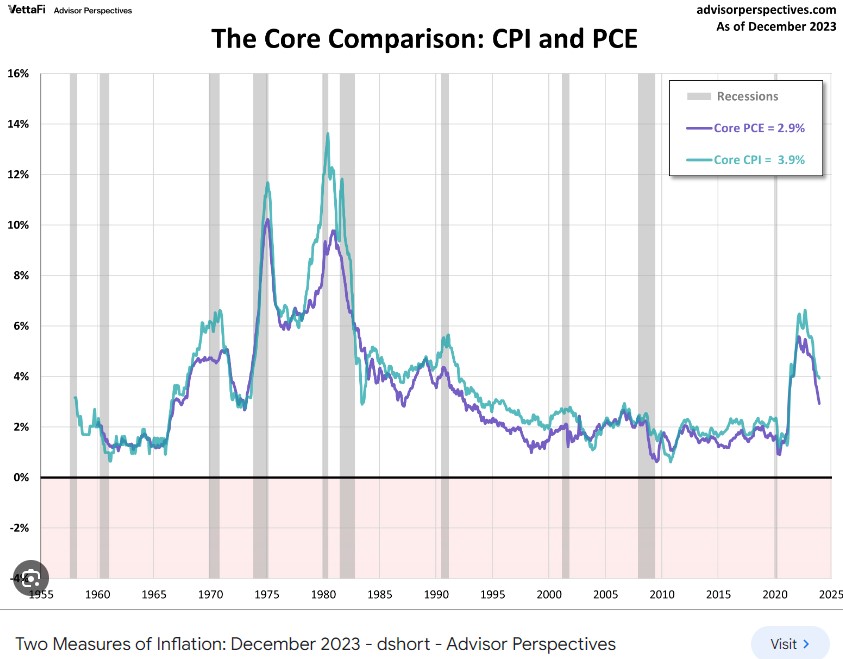

The second graph demonstrates the divergence and that we are closer to the target 2.0% inflation than we realize.