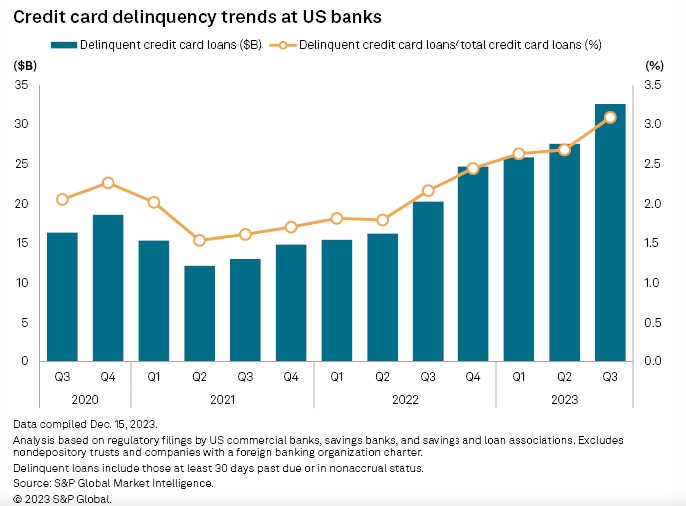

Consumer financing companies like Affirm play a vital role in providing options for individuals who may not have access to or qualify for traditional credit cards. However, the increase in consumer debt by 12% since 2022 raises important considerations about financial health and its impact on discretionary income

The challenge lies in how effectively consumers manage and repay these debts, as it directly influences their ability to pay for non-essential purchases later on.

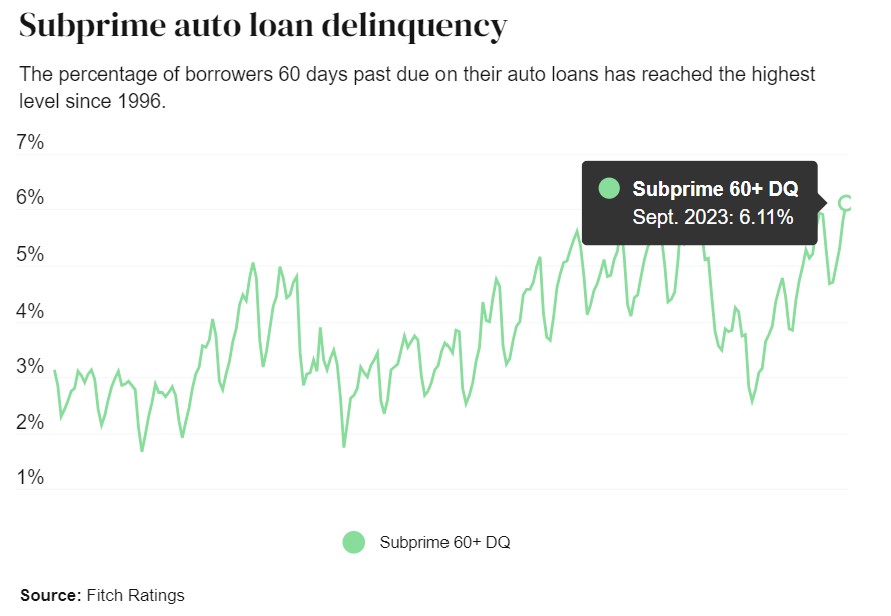

How healthy are the consumers? well it depends on when you look. Consumer spending is up, but how is the big question. Retailers are already seeing the pinch as buyers are becoming more savvy leading to more cautious spending habits.

This will bring prices down as competition for the consumers attention rises.

Tomorrow morning the Consumer Price Index – CPI will be out and expected to drop from 3.4% to 3.0%. This is positive news for the Bond market as we expect rates to continue to drop.