The Bureau of Labor and Statistics (BLS) reported 353,000 Jobs created in January, which is double the expectation.

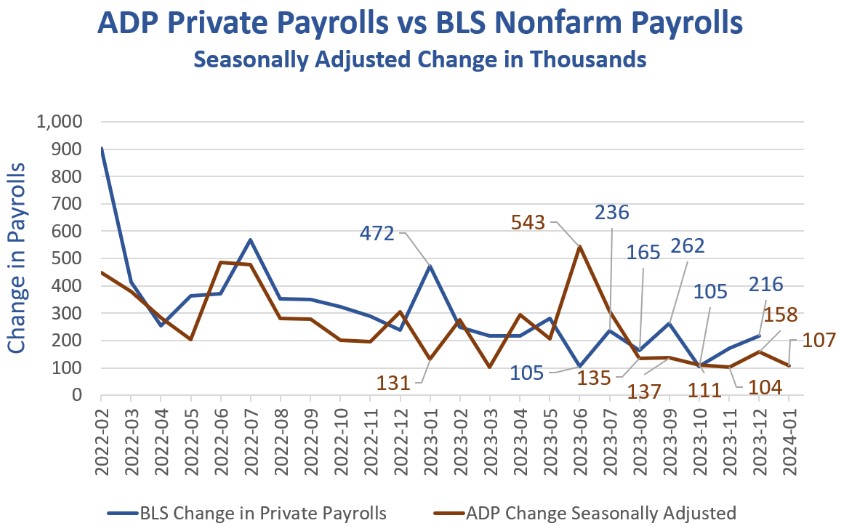

What is really odd is the contract to the ADP report that only showed 107,000 jobs created.

Here is another contrast between the two reports. Average hourly earnings, which measures wage pressure on inflation, rose 0.6%. This is double the expectation. ADP showed significant declines. ADP samples 10M actual employees.

Average weekly hours worked declined from 34.3 to 34.1. The lowest level since 2010 (minus the pandemic). This is why hourly earnings rose. Working less hours but producing the same result. This translates to 30 minute less per week compared to January 2023. This is a way for businesses to cut costs.

However, amidst these contrasting data points, a challenge persists with the potential manipulation or omission of crucial data elements.. The BLS report has two components, the Business Survey and the Household Survey. The Business Survey is the headline report. The Household Survey is where the unemployment rate comes from.

The Household Survey was much much weaker than the headline 353,000 jobs created.

I’m rambling here but bear with me. All this data, regardless of how it’s presented, paints the picture the Feds want. Weaker economy and inflation. This translates to the Feds lowering their rate sooner than later and the Mortgage rates will follow.