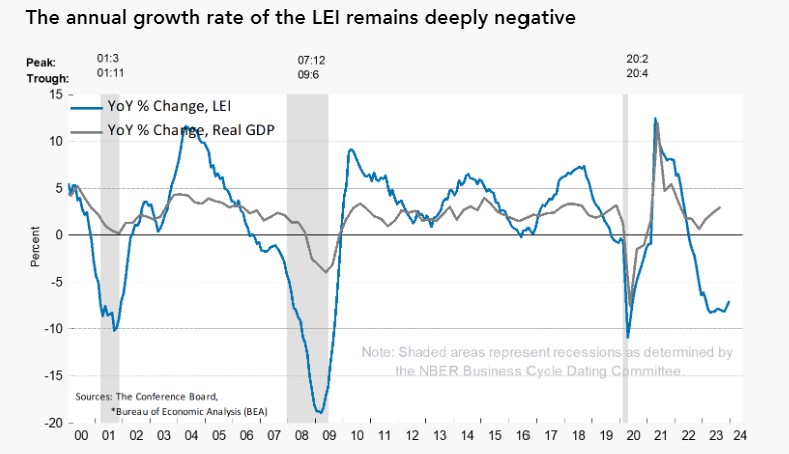

LEI, or the Leading Economic Index, serves as a comprehensive indicator aiming to anticipate the global economic trajectory. It assesses various data sets, including the yield curve in the bond market, durable goods orders, the stock market, manufacturing orders, building permits, and the Producer Price Index (PPI).

Imagine it as a panoramic view of everything happening worldwide, all considered simultaneously. Remarkably, this marks the 21st consecutive month of negative readings.

The Conference Board, the entity behind the LEI release, is indicating a potential negative GDP growth in Q2, with expectations of recovery in Q3 of 2024.

In my perspective, this might explain why, despite low employment and decreasing inflation, there’s a pervasive sense of unease about the economy. The overall trend suggests a gradual slowdown, not rapid but noticeable.