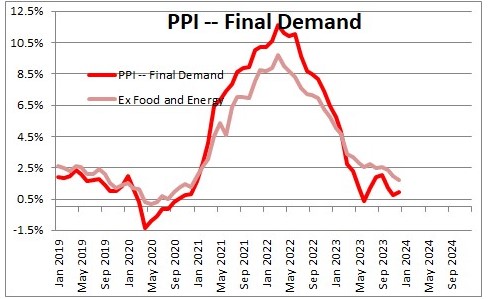

The Producer Price Index (PPI) report indicates a decrease in wholesale or producer inflation, contrary to market expectations. Here’s a breakdown of the key points:

- December PPI Movement:

- Actual: -0.1%

- Expected: +0.1%

- This means that prices at the wholesale level fell by 0.1% in December, against the market’s anticipation of a 0.1% increase.

- Year Over Year (YoY) Rise:

- Actual: +1%

- Expected: +1.3%

- The YoY rise is only 1%, falling short of the market’s expected 1.3% increase.

- Core Rate (Excluding Food and Energy Prices):

- Actual: 0%

- Expected: +0.2%

- The Core Rate, which excludes volatile items like food and energy, remained unchanged at 0%, while the market expected a 0.2% rise.

Implications:

- Lower inflation: The decline in producer prices suggests lower inflation, which can benefit consumers as cost savings may be passed on to them.

- Mortgage rates: Lower inflation often translates to lower mortgage rates, which could spur the housing market.

Future Outlook:

- The data might increase the likelihood of the Federal Reserve (FED) lowering interest rates in March. Lower inflation and the potential for economic stimulus are factors that could influence the FED’s decisions.

Conclusion: The PPI report indicates a trend of lower inflation, potentially leading to benefits for consumers and impacting financial markets. Keep an eye on how these trends evolve, especially with regard to FED decisions. Have a great weekend, and see you on Tuesday!