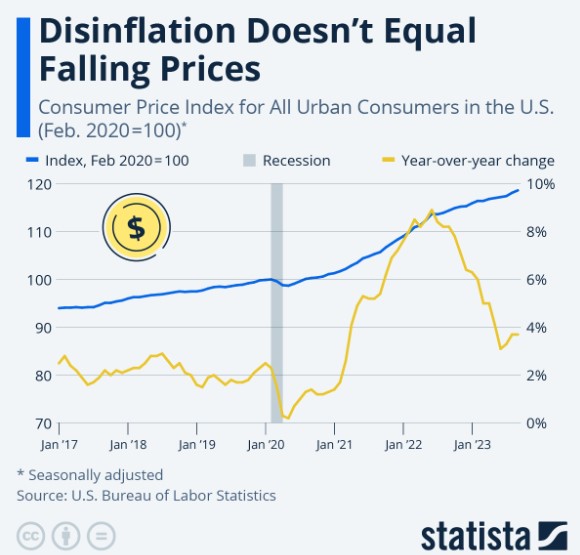

Consumer Price Index (CPI) numbers are in, with inflation rising by 0.3%, slightly higher than expected. We are now at 3.4%.

Taking a closer look, these are year-over-year comparisons, so as we move forward, the previous year’s inflation data comparison becomes tougher to surpass.

You may hear that the last mile is the toughest. The Fed wants a 2% inflation rate.

One reason consumers are dissatisfied, even though the unemployment rate is at historic lows, inflation has dropped significantly and new and used car sales have dropped over 37%, is because what you purchased a year ago is over 7% more expensive today.

If inflation were 0%, that loaf of bread would still cost 7% more than last year.

Disinflation is the slowing of inflation, which is what has happened over the past year.

Deflation occurs when the inflation rate is negative, and prices are falling.

We are in the Disinflation period not Deflation.