For the past two years, the Fed has been selling off its balance sheet of Treasuries or Bonds. The impact is the reduction of the money supply, making it more difficult and expensive to borrow money, in turn, slowing the economy and raising interest rates.

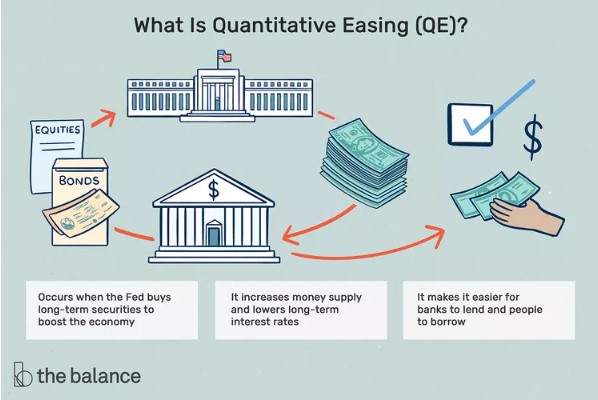

On the flip side is Quantitative Easing or QE. This is what the Fed had been doing starting as far back as the 2008 financial crisis and ending two years ago. The effect of all this purchasing has been lower interest rates and arguably, artificially low interest rates.

QE is used when the Fed wants to stimulate the economy and reduce interest rates on long-term securities.

Dallas Fed President Lorie Logan said she feels it’s appropriate to consider reducing QT or their sell-off of the balance sheet.

This is another data point when the question comes up: ‘When will interest rates drop?’”