BLS – Bureau of Labor and Statistics has revised their prior numbers lower every month on average by 40k, totaling almost 500,000 job revisions since January 2023.

October was revised lower by 45,000 to 105,000, and November from 199,000 to 173,000.

The market relies on these data points, but if you can’t trust the data, who can you trust?

This morning, the market reacted negatively to the better-than-expected jobs numbers but then remembered two things: it’s December’s numbers, which are always strange, and the anticipated revised numbers surely to come out next month.

The 10-year bond yield is lower but started off the morning up.

Average Hourly Earnings rose 0.4%, hotter than estimates. This puts pressure on inflation and the Fed’s pending rate cuts.

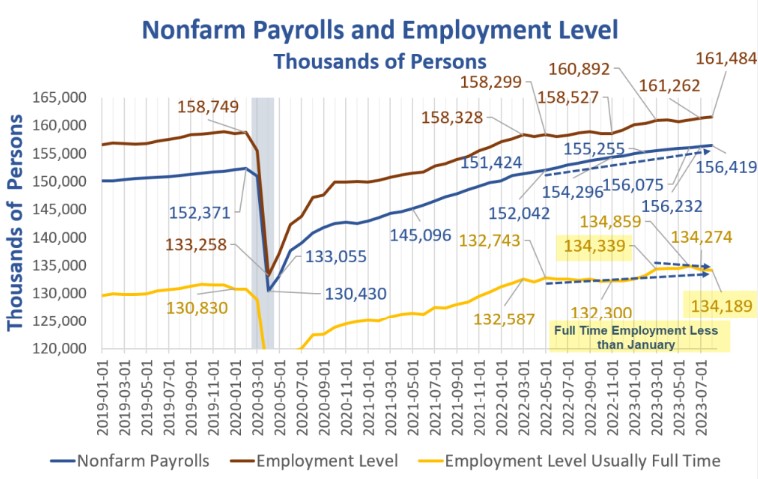

But as we look under the covers, the actual job creations to job losses paint a weakening picture with more part-time jobs. This is why the bond market shifted gears to our positive, i.e., lower rates.

It takes a bit to read and digest the vast amount of data that came in this morning, so we forgive the market for initially overreacting.

Slightly dated graph, but it still gives me a headache just looking at it.