As more homes are completed, the pressure on the rental market persists. According to CoreLogic, rent prices have increased by 2.5%, though this is lower compared to the previous report.

Housing starts experienced a significant rise of almost 15% in November, reaching 1.56 million, marking a 4% increase year-over-year. Single-family permits also saw a 0.7% increase and are 23% higher compared to the previous year.

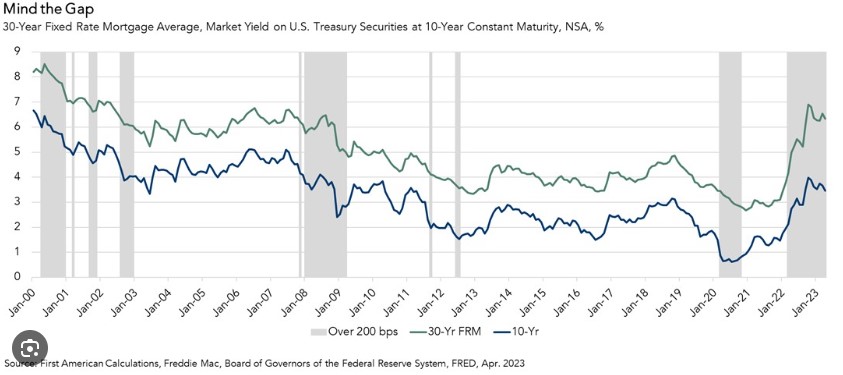

Interest rates have continued to show improvement over the last month, with hints of a possible decline in the coming months.

The Federal Reserve is discussing the possibility of three rate cuts in 2024, with the potential for four.

Interest rates, in general, are approximately 2 points higher than the current 10-year yield, which stands at 3.917 at the time of this blog. Despite this, the national average for a 30-year mortgage is 6.65. This indicates that there is room for rates to drop further, even if the 10-year yield remains steady.