Let’s break down what the Fed said at yesterday’s meeting. They sounded much more dovish than hawkish, notably stating that meaningful progress on inflation has been made and downgrading their view of the economy.

Powell mentioned that the Fed will not wait for inflation to reach their target before making cuts. Instead, they would act well in advance to account for the lags.

The prevailing thought is that once inflation is below 3% (currently at 3.14%), it will be the green light to cut.

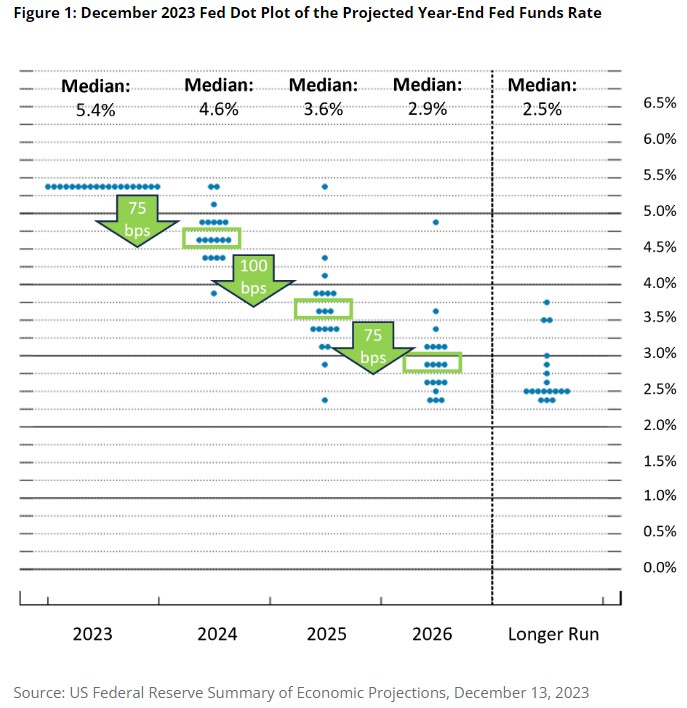

The Fed’s Dot Plot chart below is quite revealing. The majority believes that the Fed will cut between 50 to 100 basis points, with one member advocating for a 150 basis point cut and another proposing no cuts.

Each dot represents a Fed member’s projection of future rate cuts.

We are now at an 84% chance of cuts in March, aligning with my projections over the last few months.