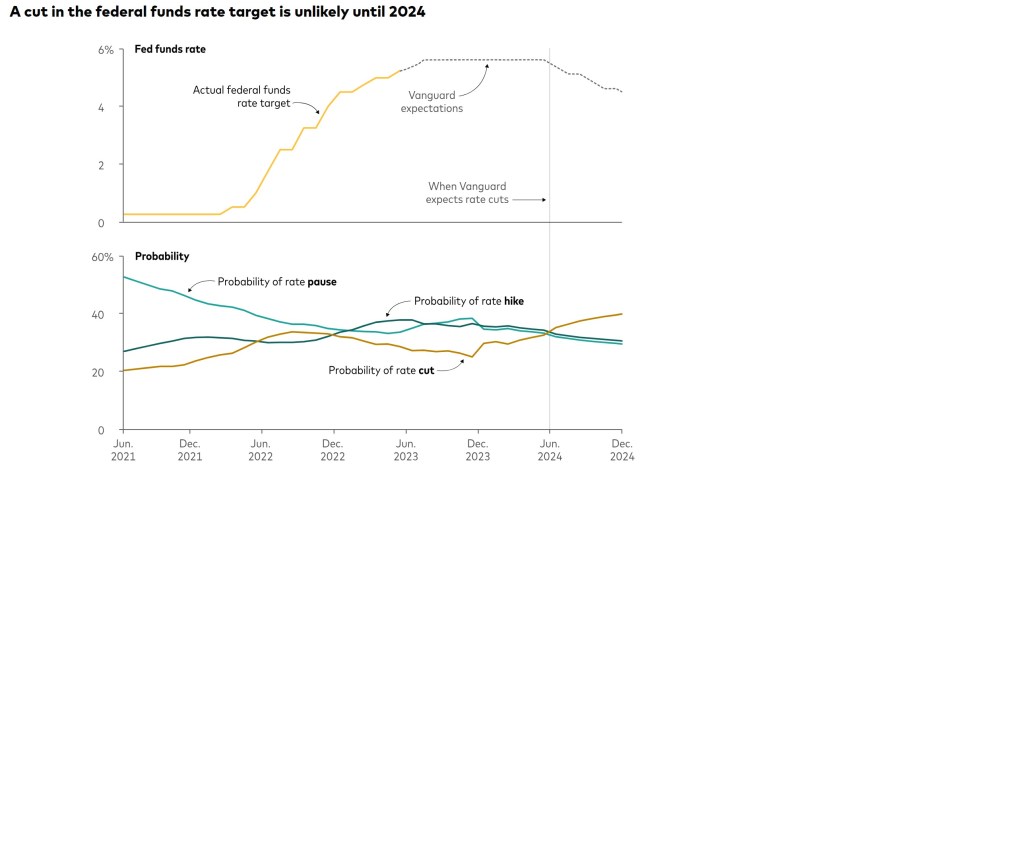

Now that I have your attention, let’s talk rates, mortgages, and the Fed. With the holidays upon us, the inevitable question at gatherings is, ‘What do you do?’ The next question is, ‘When will rates drop?’

The short answer is, no one knows. That’s the safe response. However, given that I woke up way too early this morning, even for me, I’m not feeling safe.

There are strong indicators that rates will drop. Inflation is set to decrease significantly. The car industry has returned to reality, and big-box companies may have overstocked their shelves. It’s all about supply and demand.

Supply is up, and demand is waning. Oil prices have also declined, including rent, particularly with commercial rentals. We are running out of Pandemic government money and waking up to the correct reality.

I am excited for 2024.

Look for the Fed to make overtures in January/February for potential rate cuts. Home inventory will grow, as will demand. Get ready for 2024.