Average, Normal, predictable all good words the market loves. Initial Jobless Claims came out remaining at a relatively low 217,000. Continuing Claims rose 22,000. Employers are holding onto their workers.

Interest rates are holding their gains over the past week. We are advising our clients to Float any existing pre-locks as we watch the 10-year Mortgage50-day moving Average.

There are floors and ceilings in the stock and bond market. These are imaginary barriers but turn out to be real resistance levels. Right now the 10-year bond broke beneath that 50-day average at 4.57and has created a new ceiling. The floor is 4.42% and if we can fall through we will continue to see rate improvement.

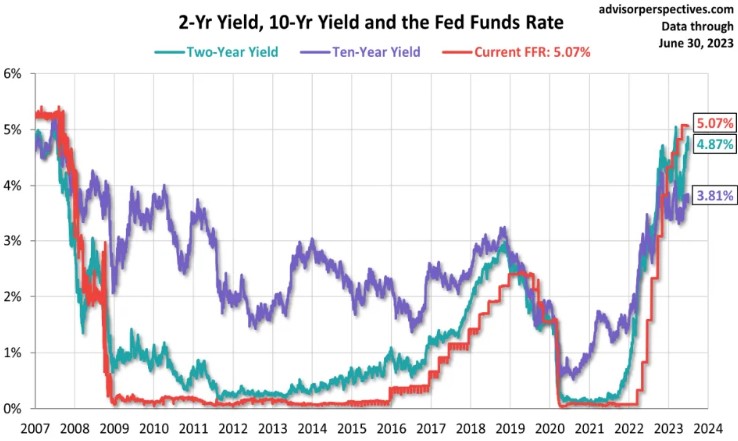

Looking at the graph below, Normal for the 10y bond is arguably around 3.00%. we are at 4.57%. I want my cake and eat it too but that’s not realistically in the cards.

2024 will be an amazing year, I see it coming. Feds will lower their Fed Funds Rate, Bonds will be back to normal and Mortgage rates should be more palatable.