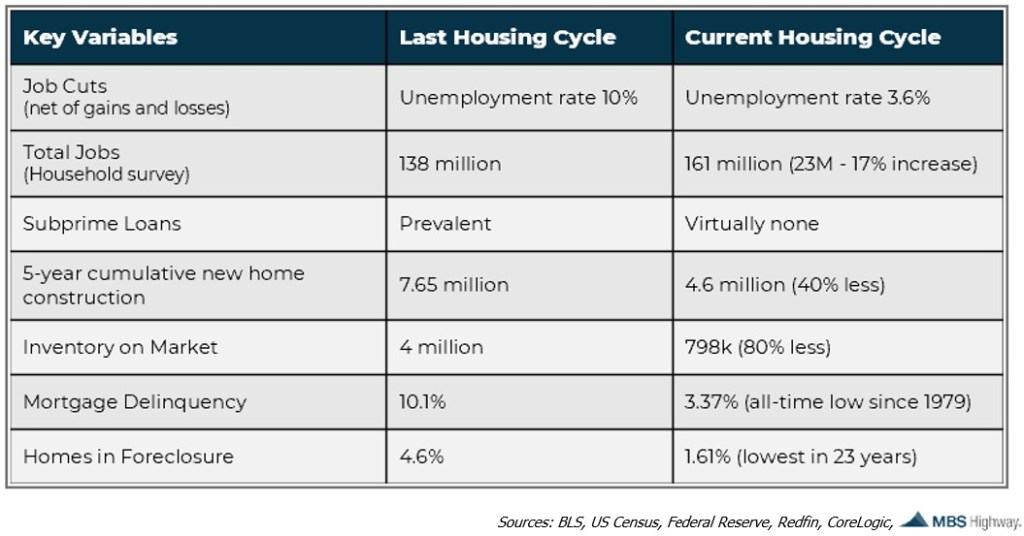

In the news and always on social media is the drumbeat of the highly anticipated housing crash. This is False and the numbers bear it out.

Unemployment rate at historic lows, no Subprime loans, low inventory, Mortgage delinquencies and minimal homes in Foreclosure.

Remember in 2008 when the housing market crashed, the borrowers still hanging on to their homes were looking at an Adjustable Rate Mortgage ready to mature.

The second wave of foreclosures were just around the corner.

Today we have none of that. Home Owners are highly motivated to keep their homes to preserve the low fixed rate mortgage. Home Values keep going up along with the interest rates.

There is a diminishing likelihood of a recession as the indicators are begrudgingly eking out data telling us so. The problem is its taking far longer than anyone expected.

Have a great rest of your week.