Mortgage rates are driven by the Mortgage Backed Securities i.e. Bonds. Uncertainty in many forms causes a flight to financial safety.

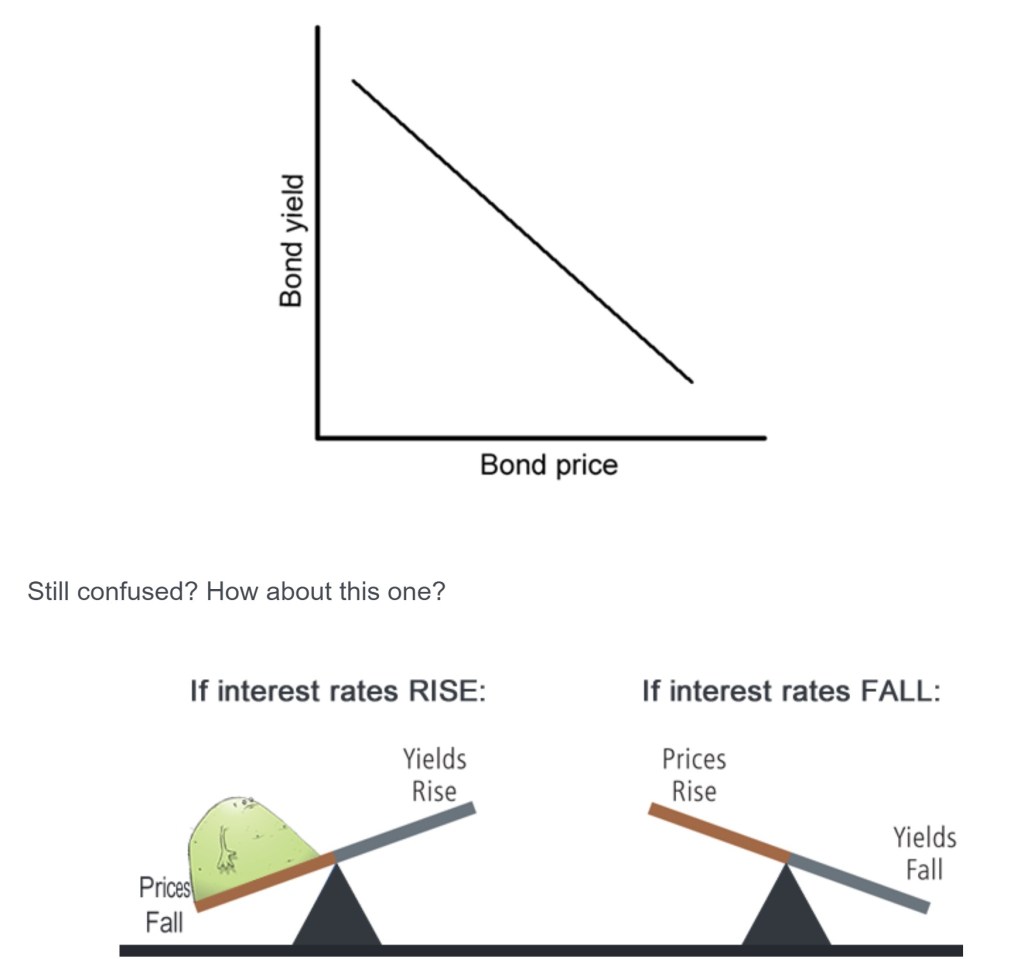

The bond market is confusing especially when you hear bond yield and bond price used interchangeably.

During the financial crisis in 2008, the US Government was purchasing bonds at a breakneck pace. This caused the bond prices to go up and the interest rates to drop.

When the Federal Reserve buys bonds, bond prices go up, which in turn reduces interest rates. Open market purchases increase the money supply, which makes money less valuable and reduces the interest rate in the money market.

We have seen some rate improvement this morning as expected.