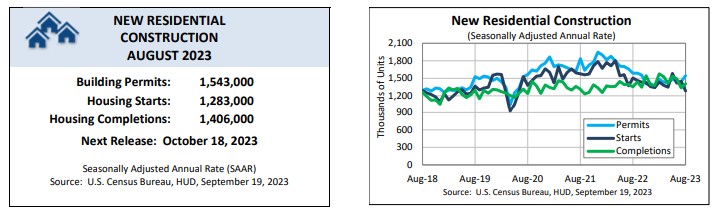

Supply is not keeping up with demand. Housing Starts fell by 11% in August. This means we are 15% down from last year. The decline was mainly in Multi-Family homes.

Single family starts fell 4% last month but up 2% Year over Year. Housing permits, which foreshadow the future supply, were up 7%, but down 3% from last year.

To put this into context. The Demand for new construction housing is 2M+ units. Actual production is 1.4M units. This is one of the reasons housing prices continue to rise.

Not to be too depressing but here are a bit more data points.

Current Sales fell 6%, Future Expectations fell 6 points and below 50%. Buyer Traffic fell 5 points.

Rising mortgage rates, lack of workers and buildable lots, and ongoing shortages of distribution transformers that connect the home to the grid.

To defend the Builders, they are the ones taking the risk. Spend all that money on land, materials and labor in hopes that one year or two years later you made the right decision with no control over inflation or interest rates.

I promise I will be happier tomorrow.