NY Fed Pres John Williams said monetary policy is in a good place. He also said recession talks have now vanished.

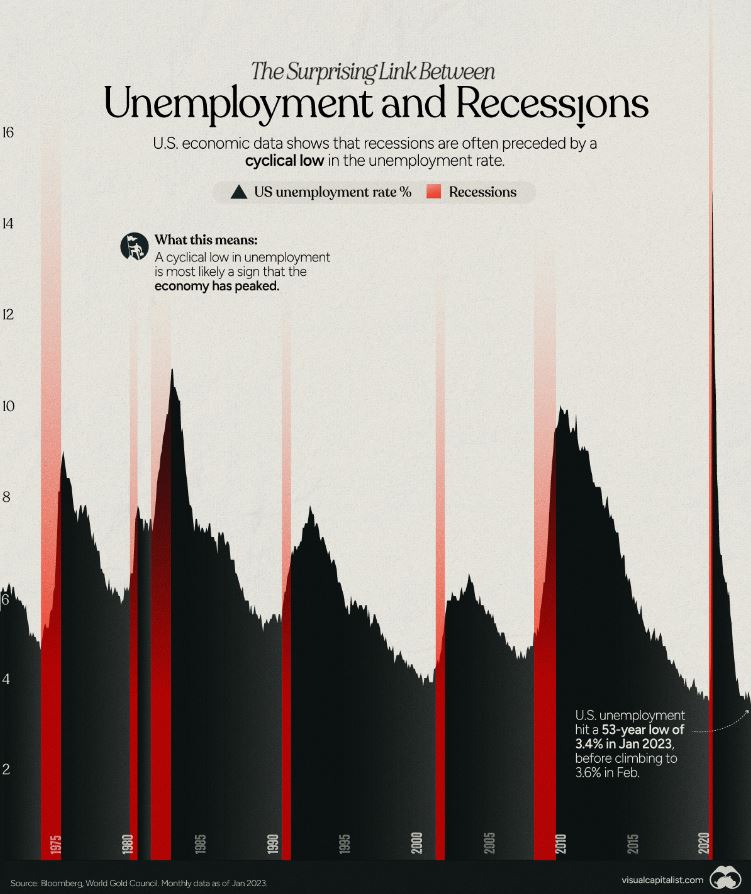

Here is the interesting part; how can there be a recession if the unemployment rate is so low. and we never get recessions when the unemployment rate is higher.

It’s about the differential. When the unemployment bottoms and then moves higher, that is when we see a recession with 100% accuracy. Unemployment then moves higher during the recession. The April unemployment rate was 3.4% now it’s 3.8%.

Consider what we are up against this fall. Higher spending on credit cards. Those cards have higher rates, the delinquencies are higher, student loan payments are coming, savings rates are declining, and almost all of the excess from the stimulus is spent out of the system.

The silver lining is if we were to see a recession, inflation and mortgage rates would decline as they always do.