Let’s try to wrap our heads around Bonds. They are the vehicle that drives the interest rate for Home Mortgages, specifically 10y Bond.

What is the difference between Bond Yield and the Bond Price.

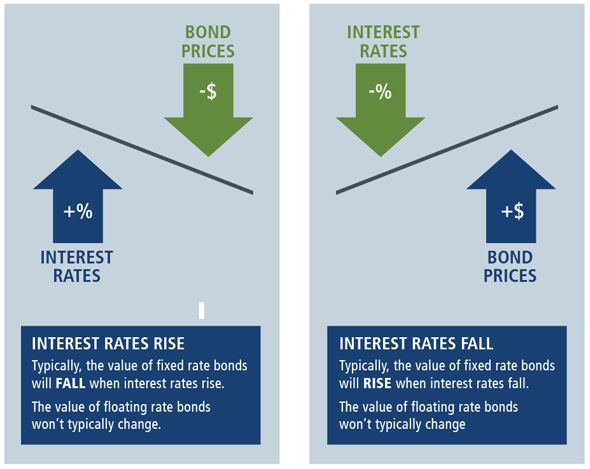

If you buy a $1000 bond at the issuance date, the bond price is the face value of the bond. The Yield will match the coupon rate of the bond. All good and if you have a 1% interest rate for a 10y bond, that is what you will be paid out until the maturity date when you get your initial purchase back.

Let’s imagine you buy the same bond but six months later. The new public offering or issuance date is now 2% interest. How does this affect your Bond locked in at 1%?

If you never plan to sell, it does not matter. You locked in your yield.

If you plan to sell, your new Yield is now based for this example on a lesser valued Bond. That old bond may trade at $980 which then translates to a lower yield over time.

What we are seeing in the market is a huge Shorting of the Bond market. The current short interest in 10-year Treasuries (bonds) rose over $800 Billion up 20% just in the last month.

“For the last few decades, if you asked when shorting bonds would be the trade of the year, you might get the classic response: when pigs fly,” she wrote. “I guess we can say that pigs have been flying around in 2022.”

What this all means is we anticipate rates dropping this summer.