Most of the talking heads and saying we will not or most likely will not have a recession. Here are a few indicators that say otherwise.

- The Yield curve is severely inverted. This means the 2y note has a higher yield than the 10y note. Usually a longer term means higher yield. Why buy a 10y when the 2y is more profitable.

- The full impact of the slowdown has yet to be felt from the Fed hikes.

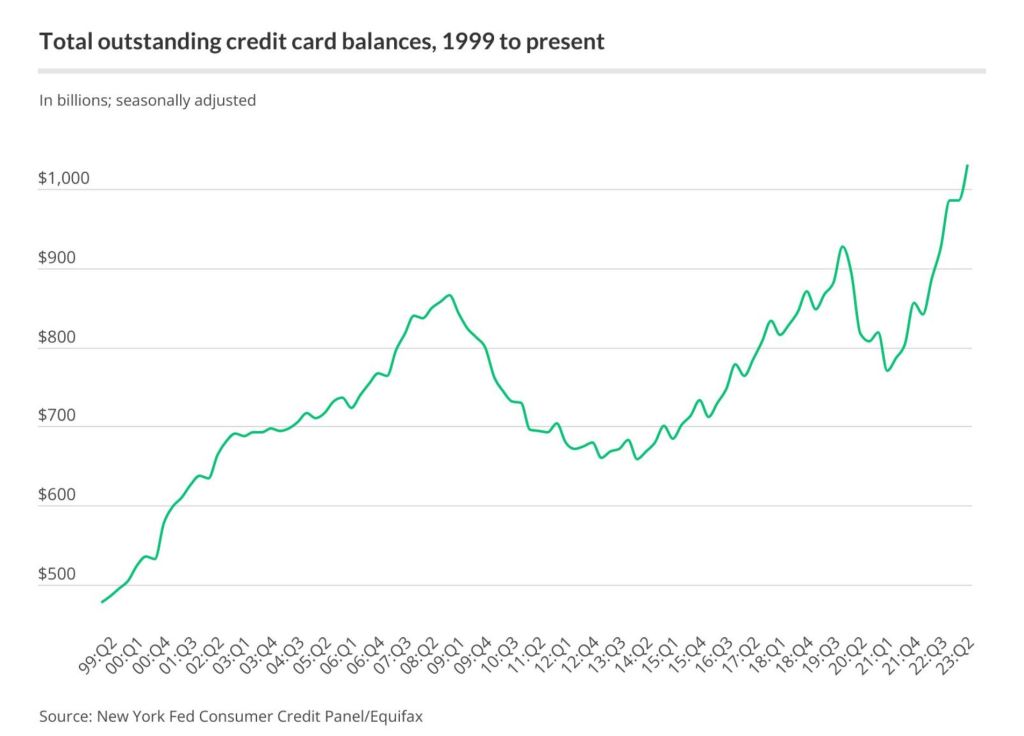

- A lot of consumer spending but a lot on credit cards now surpassing $1T in credit card debt.

- Student loan payments start October 1st.

- Excess savings from the stimulus was $500B in march but is now $190B in June. this money will go away in the next month or so.