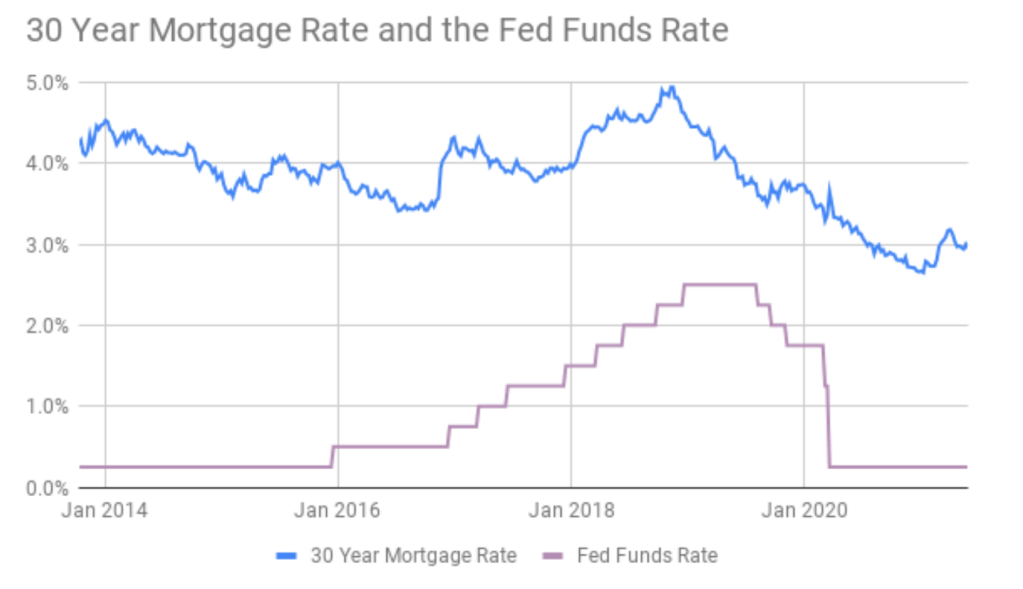

I love graphs, they tell you so much with so few words. But first lets quickly understand the difference between the Fed Funds rate and the Mortgage Rate.

Fed Funds Rate is the rate banks borrow overnight to satisfy liquidity requirements set by regulators. Banks then pass that rate to its clients affecting short term lending:

- Car loans

- Credit cards

- HELOCs Home equity line of credit

- ARMs Adjustable Rate Mortgages

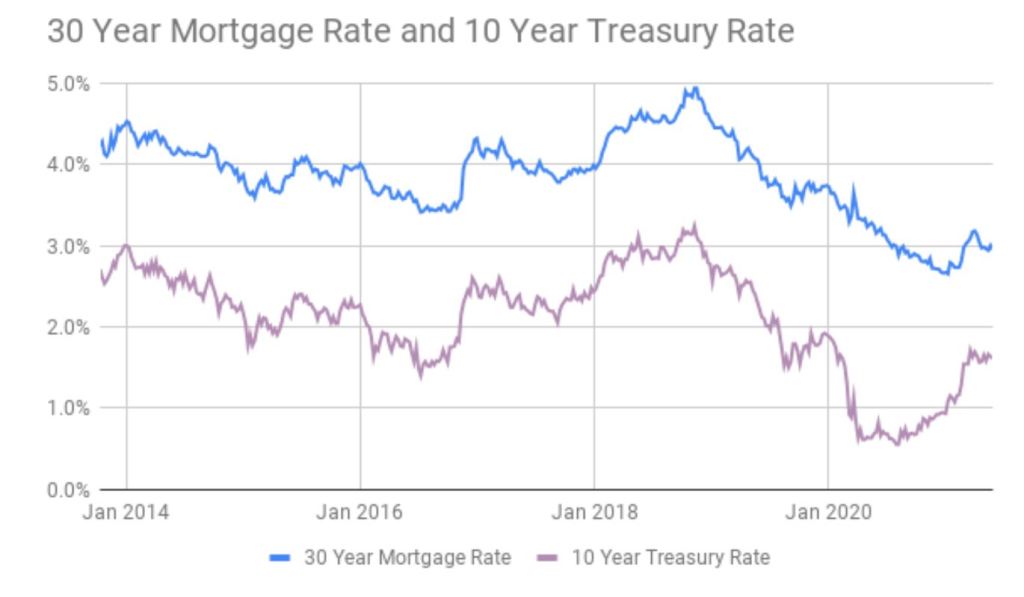

Mortgage Interest Rates reference the yield on the 10-year Treasury bonds.

When the Fed raises rates, Mortgage rates typically go down.

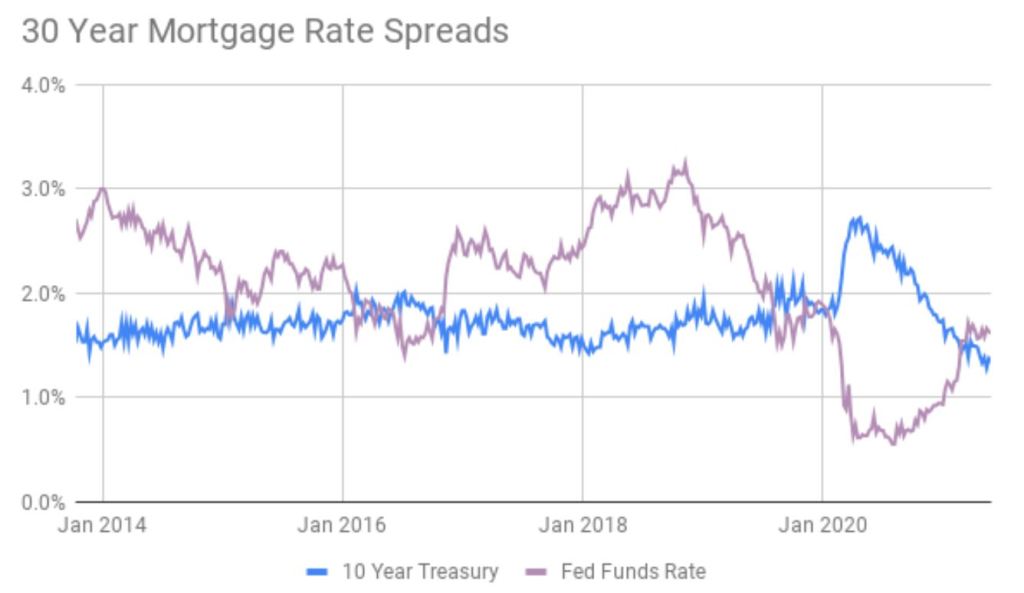

This is the 10 Year Treasury bond vs the Fed Rate.

Let’s now look at the 30 Year Mortgage vs the 10 Year Treasury Rate

In conclusion…. When you hear the Feds are raising rates, run to your lender to get pre-qualified for a Mortgage or ask about refinancing your loan.

Have a great rest of your week and always feel free to reach out.