In the last week my inbox and on the internet has been flooded with this “new” unfair tax on mortgage borrowers with higher credit scores.

Before you Stop paying your bills to cash in on better pricing, let’s separate fact from fiction.

- You will absolutely NOT get a better deal on a mortgage rate if your credit score is lower.

- Low credit borrowers are not paying less than a high credit borrower.

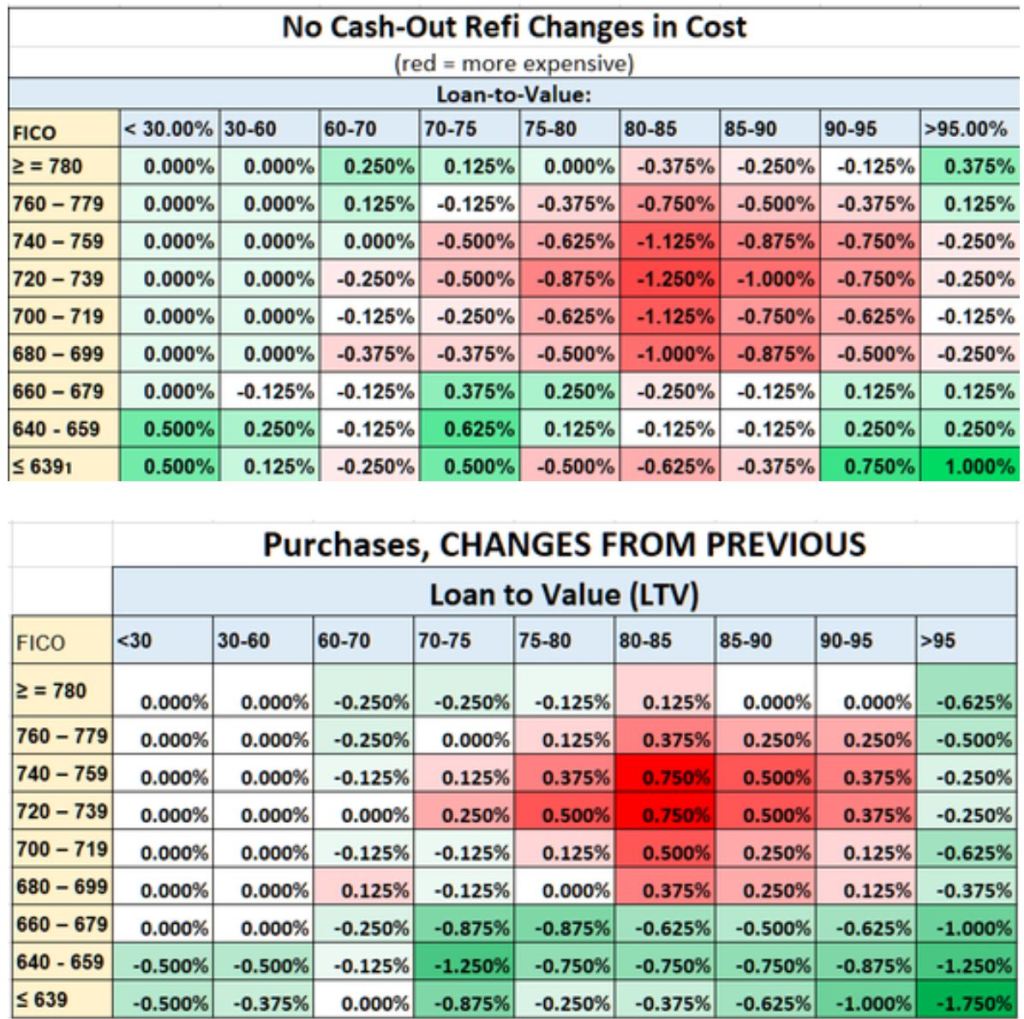

Let’s look at some charts. Red = rising costs. Green= Falling costs.

If you saw the first two charts or it’s your first time seeing them, you can be forgiven to think a low credit borrower is paying less than a high credit borrower.

*LLP is Loan Level Pricing , % cost of the loan amount. That is the % reference in the charts below.

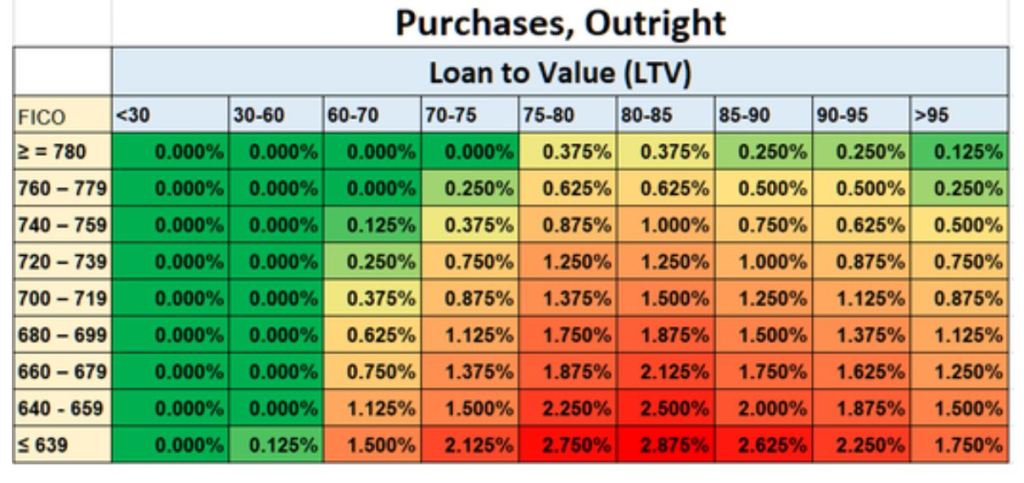

Let’s now look at the ACTUAL cost not the CHANGE.

If you have a 640 credit score, You’ll be paying significantly more than if you had a 740 score.

Freddie and Fannie have a “mission” to promote affordable home ownership. Their comments in the link below.

https://www.fhfa.gov/Mhttps://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Announces-Updates-to-Enterprises-SF-Pricing-

Its earnings week so be ready for a bit of a volatile week.