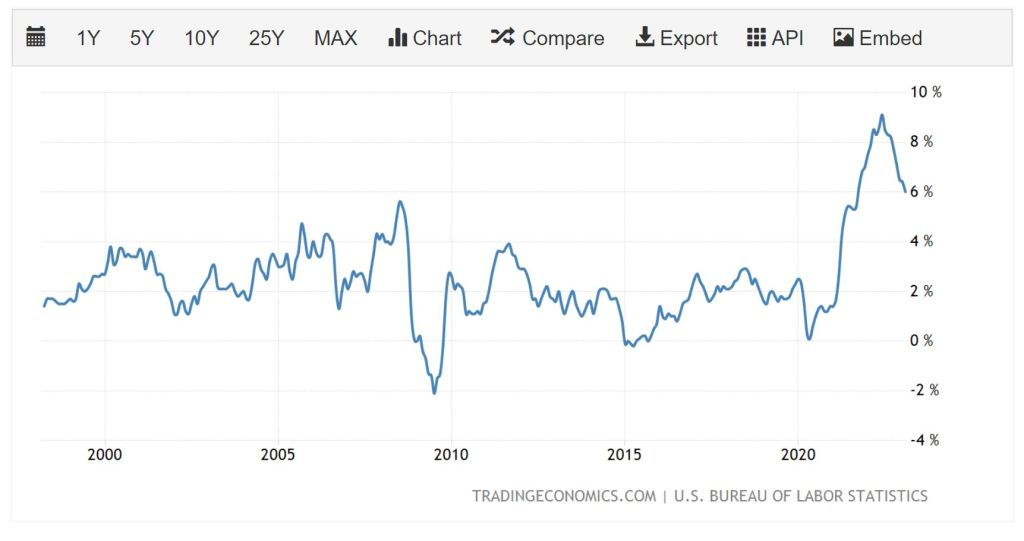

The Fed has raised the benchmark interest rate from zero 12 months ago to 4.75%. This is the steepest rise in US borrowing costs since the 1980s. All to squash inflation.

Higher rates encourage savings over spending. As more consumers stop buying goods, those employed to produce those goods lose their jobs.

The March inflation report will be coming out Wednesday. These numbers are replacing last years and reflect a year over year change. Expectation no change or higher.

Zillow Home Value Index shows home prices rose 0.9% in March, the highest since the peak in June 2022. Home prices are up 3% year over year. Inventory is still the biggest challenge. It keeps home values up but makes it difficult for buyers with multiple offers.

We have a busy week with the Consumer Price Index Wednesday, Initial Jobless Claims Thursday and Retail Sales this Friday.

Its only Monday morning but feels like the middle of the week.